FEMA application pertaining to Inheritance

This article is updated and the link is available at - Succession issues under FEMA

June 2025 ![]()

Naresh Ajwani

Chartered Accountant

May 2022

Contents page

|

Para No. |

Content |

|

Abbreviations. |

|

|

1. |

Background. |

|

2 to 7 |

Different situations. |

|

2. |

Testator is an Indian resident, has Indian assets and non-resident heirs. |

|

3. |

Testator is an Indian resident, has foreign assets and resident heirs. |

|

4. |

Testator is an Indian resident, has foreign assets and non-resident heirs. |

|

5. |

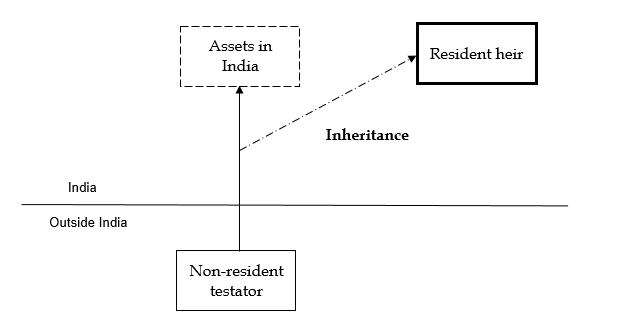

Testator is a non-resident, has Indian assets and resident heirs. |

|

6. |

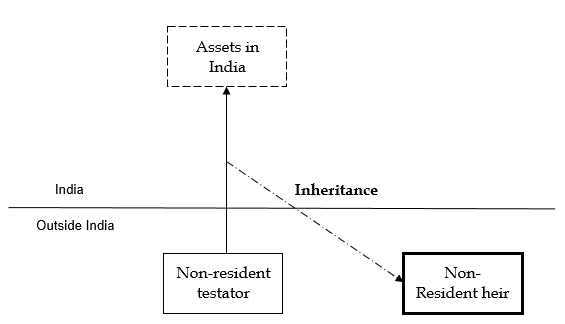

Testator is a non-resident, has Indian assets and non-resident heirs. |

|

7. |

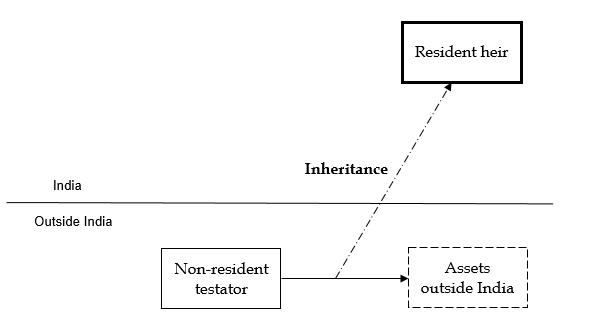

Testator is a non-resident, has foreign assets and resident heirs. |

|

8. |

Legal proceedings. |

|

9. |

End Note |

|

Annexure A |

Extracts of FEMA law – Act, Rules and Regulations providing for inheritance in case of resident heir |

|

Annexure B |

Extracts of FEMA law – Act, Rules and Regulations providing for inheritance in case of non-resident heir |

Abbreviations

| FEMA |

Foreign Exchange Management Act |

| FERA |

Foreign Exchange Regulation Act |

| GOI |

Government of India |

| IP |

Immovable Property |

| LRS |

Liberalised Remittance Scheme |

| NDI rules |

Non-Debt Instrument Rules |

| Notn. |

Notification |

| PIO |

Person of Indian Origin |

| R. |

Rule |

| RBI |

Reserve Bank of India |

| Reg. |

Regulation |

| RFC account |

Resident Foreign Currency Account |

| S/Ss. |

Section / Sections |

| SNRR |

Special Non-Resident Rupee Account |

1. Background:

1.1 Will is a statement (document) by the author of the Will. It lays down the author’s intention for distribution of his assets owned at the time of death, to the heirs in a specified manner. There can be oral Wills also. However written Will is always better. Normally the heirs are close family members. Some people provide for distant relatives, employees, well-wishers and charitable organisations.

The act of making provision for the heir in the Will is known as bequest. The act of acquiring property by the heir is known as inheritance. Author of the Will is known as testator.

Will is an important part of succession planning. Others include gift during lifetime, and settlement in a Trust. For Foreign Exchange Management Act (FEMA) provisions on Trust and succession planning, visit our website – www.rashminsanghvi.com.

1.2 In this article, FEMA provisions pertaining to Inheritance are covered. Where the Testator and heirs are Indian residents and assets are in India, FEMA does not come in the picture. Similarly, where the Testator and heirs are non-residents and assets are outside India, FEMA does not come in the picture. When the inheritance involves Cross Border transactions, FEMA comes in the picture. However FEMA is peculiar. Even transactions which are ostensibly not covered under FEMA, may require a permission from RBI. (See para 7.5).

1.3 FEMA has to be considered for bequest / inheritance, holding the inherited assets, sale of the assets, and repatriation of funds abroad in case of non-resident heirs. Similarly, FEMA has to be considered for bequest / inheritance, holding the inherited assets, sale of the assets, and remittance of funds into India in case of Indian resident heirs.

Some situations require an approval from RBI. Some may be under automatic route – i.e. RBI may already have permitted holding, sale, and remittance of funds in the FEMA notifications.

It may be noted that by and large where the provisions do not allow the heir to hold on to the assets, or retain funds abroad, or repatriate the funds outside India, an application to RBI is also unlikely to be successful. RBI generally follows the policy laid down in the rules and regulations.

1.4 Unfortunately FEMA is not drafted in a user-friendly manner. Further there are a few provisions dealing with inheritance specifically. These provisions are spread over many notifications. This causes a lot of difficulties. FEMA is drafted in such a manner that all cross border financial/commercial transactions are covered. Every “Covered” transaction needs a permission –either a general permission; or a specific permission. RBI & GOI attention is on investments, loans, exports & imports. Other items like trusts & inheritance are insignificant from regulator’s perspective. Hence some provisions have not been made under FEMA. Where ever there is a gap in the regulations, RBI itself is confused & refuses to take corrective actions.

We assume that a law must be complete in areas where it is applicable. Then try to interprete the law. But fact is that FEMA is incomplete & confusing.

When faced with such a situation, options available to the person are:

-

Avoid the situation. In other words, do not make a Will where your heirs will have to go seek RBI permission. Or

-

Be prepared to apply to RBI & take a permission. Do not plan/ enter into a transaction which is not permitted under FEMA.

FEMA legal provisions dealing with inheritance are reproduced in the Annexures. In Annexure A, provisions applicable to Indian resident heirs are reproduced. In Annexure B, provisions applicable to non-resident heirs are reproduced.

Provisions for inheritance by resident heir deal only with the following:

- foreign currency outside India,

- foreign security outside India,

- immovable property outside India,

- foreign exchange,

- foreign currency account,

- exemption from realisation and repatriation of foreign exchange,

- surrender of foreign exchange to bank.

Provisions for inheritance by non-resident heir deal only with the following:

- Indian currency in India,

- Indian security in India,

- immovable property in India,

- remittance of funds abroad by foreigners (Non-NRI/Non-OCI), and

- remittance of funds abroad by NRI / OCI,

(As an example of gap in FEMA, specific regulations for gold are not there. There are also no specific regulations even for bank account. There are some regulations of nomination in case of non-resident’s bank account, but not for inheritance. Nomination is different from inheritance.)

Some provisions such as remittance of funds abroad apply generally to all assets. Some provisions are specific to the asset.

1.5 For this article, the matter has been divided two situations as under –

- Testator is an Indian resident on death.

- Testator is a non-resident on death.

Testator’s assets are in India and abroad. Heirs are in India and abroad.

Situation of testator also can have implications. For example, if the testator has acquired a property in London while he was a non-resident of India. At the time of his death, he could be a non-resident of India, or he could be an Indian resident. Both these have different outcomes. See paras 3.2.2 to 3.2.4.

1.6 The executor of a Will is responsible for distribution of the assets to the heirs. In some situations he may have to apply to RBI for approvals / distribution etc. However the executor’s status does not affect the inheritance.

1.7 For bequest to anyone there is no restriction. However for inheritance, in some situations, approval from RBI is required. There may be further restrictions on holding the assets, sale and repatriation of funds. Hence the issues are mainly for inheritors – inheritance, holding the assets, sale of assets, repatriation of funds.

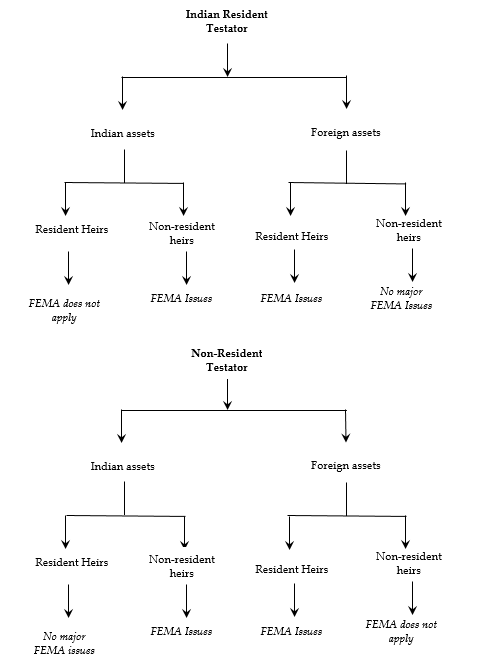

1.8 There can be several situations. A chart is given below.

Thus there are 6 situations in which FEMA has to be considered. The table lays down same situations as in the chart above, but in a tabular form.

|

Sr. |

Testator |

Assets |

Heir |

Para dealing with this situation |

|

1. |

Indian resident |

Indian asset |

Indian Resident |

NA |

|

2. |

Indian resident |

Indian asset |

Non-resident |

2 |

|

3. |

Indian resident |

Foreign asset |

Indian Resident |

3 |

|

4. |

Indian resident |

Foreign asset |

Non-resident |

4 |

|

5. |

Non-resident |

Indian asset |

Indian Resident |

5 |

|

6. |

Non-resident |

Indian asset |

Non-resident |

6 |

|

7. |

Non-resident |

Foreign asset |

Indian Resident |

7 |

|

8. |

Non-resident |

Foreign asset |

Non-resident |

NA |

1.9 FEMA regulations are framed according to the kind of assets. Thus immovable property, shares, loans, etc have different regulations. In this article also, I have considered the situation according to the assets of the testator.

There are no specific rules pertaining to loan, gold, bullion, jewellery, precious metals, paintings, work of art, intellectual property such as copyright.

1.10 Indian Trust:

One of the questions usually asked is – whether Indian Trust with non-resident beneficiaries can be the heir to the asset?

Briefly, there is apparently no approval required. However there being no specific provision under FEMA, it will be better to obtain an approval from RBI.

For details on Trust, one may refer to article on www.rashminsanghvi.com.

1.11 Foreign Trust:

People staying abroad, would like to have a Foreign Trust as an heir to Indian assets. Trust is an unincorporated body. It is not permitted to invest in India. Approval from RBI should be obtained for this purpose. It is debatable whether RBI will permit such a bequest. It may direct to transfer the assets to heirs. Such direction can have implications under income-tax and other laws pertaining to the specific assets.

1.12 With this background, let us see the specific rules under different situations.

2. Testator is an Indian resident, has Indian assets and non-resident heirs:

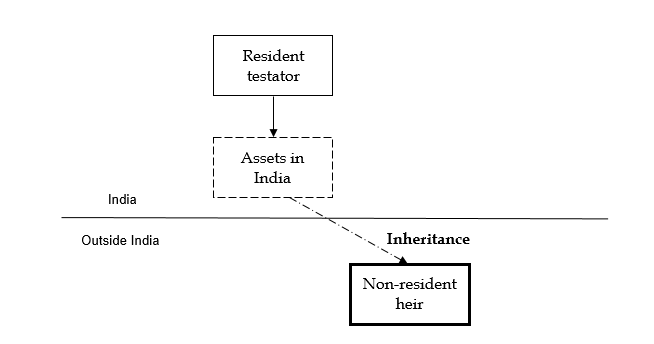

2.1 For illustration, consider Mr. Suresh Sawant an Indian resident parent has various assets in India. His children (heirs) are non-residents. On the death of Mr. Sawant, non-residents inherit the assets. Assets are of several kinds –immovable property, shares, gold etc. A simple chart is given below.

2.2 Immovable Property (IP):

2.2.1 An Indian resident can bequeath IP to anyone. However for the inheritor, one has to examine FEMA rules.

2.2.2 Under the Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (NDI rules), an NRI or OCI can inherit the IP [R. 24(c)(ii)]. Hence Mr. Sawant’s children can inherit the property as they are NRIs.

After inheritance, the IP can be sold to an Indian resident or to an NRI/OCI. However agricultural property can be sold only to Indian resident.

Funds can be repatriated abroad under general facility of US$ 1 mn. scheme. [Reg. 4(2) of Foreign Exchange Management (Remittance of Assets) Regulations, 2016].

Agricultural land, plantation property and farm house (agricultural property) can also be inherited by the NRI / OCI. However no agricultural activities can be carried out. Further such a property can be sold to an Indian resident only.

2.2.3 a) If the heir is an outright foreigner (not an NRI or OCI) or a foreign entity, an approval is required from RBI to hold the property on inheritance.

It may be noted that before 2018, a foreign citizen of Indian Origin (Person of Indian Origin or PIO) could acquire IP just as an NRI. However PIO concept has been removed for Immovable Property. Therefore if Mr. Sawant’s children have acquired foreign citizenship but have not acquired OCI, approval will be required to hold the property.

b) Subsequently if the foreigner wants to sell the IP to an Indian resident, no approval is required. The buyer should be eligible to acquire the IP. [R. 30(2)]. Under R. 31, a citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Hong Kong, Macau, Nepal, Bhutan and Democratic People’s Republic of Korea (DPRK) is not allowed to acquire immovable property without RBI approval. If such citizens are Indian residents, legally FEMA does not apply. However there is a bar on such citizens to acquire IP in India. Legally, this rule is ultra-vires as FEMA does not apply to Indian residents having Indian IP. However this is not the scope of this article. Hence it is not discussed further. One may visit our firm’s website for a presentation on Immovable Property.

Thus except for citizens of the above 11 countries, IP can be sold to any Indian resident. Practically most of the times, sale will be to Indian citizens. No approval is required for sale to Indian residents.

Sale to NRI / OCI also requires an approval.

Sale to outright foreigner is not permitted.

c) Remittance of funds - For a foreigner, a prior approval is required to repatriate the funds abroad – unless the situation is as specified in sub-para (d) below.

d) General facility for repatriation of funds – Notification No. 13(R) - Foreign Exchange Management (Remittance of Assets) Regulations, 2016 deals with repatriation facilities. These facilities are for all assets and not just IP. Discussion in this para will apply to other assets also.

One may note that sale of an asset and remittance of funds are separate matters. Notification 13(R) is for repatriation of funds. For sale, separate rules apply depending on the kind of assets.

-

Under Reg. 4(1)(iii), a widow/ widower (not an NRI or OCI) who has inherited assets of the deceased spouse who was an Indian citizen resident in India, can remit upto USD 1,000,000 per financial year. Relevant documents for inheritance should be provided by the widow / widower.

-

Under R. 29(1) of NDI rules, the heir of emigrating Indian (u/s 6(5)), can remit funds as per general or specific permission of RBI. Under Reg. 7(1)(i)(a), an executor of the Will can repatriable upto US $ 1 mn. per annum on account of legacy, bequest or inheritance to a foreign national resident outside India. Under this regulation, the foreign national can also remit funds.

-

For any other repatriation, an application can be made to RBI. If RBI is convinced of the need for repatriation, it may grant an approval.

2.3 Equity instruments:

2.3.1 Equity instruments mean equity shares, mandatorily convertible preference shares, and mandatorily convertible debentures [R. 2(k) of NDI rules]. Rules for investment in equity instruments are provided in NDI rules. For debt securities, Debt Instrument rules regulate the same. In this article, the term shares or equity shares has been used. For inheritance, whatever applies to equity shares, applies to all equity instruments.

For shares, there is no specific provision in FEMA for inheritance. Prima facie one has to consider whether the heir can own the property assuming that he had to acquire it by purchase or gift (other than inheritance). If the heir can buy the property or accept it as a gift, then on inheritance, heir can hold the same.

Let us see more details for various categories of heirs.

2.3.2 NRI and OCI – An NRI and OCI can inherit shares. NRI / OCI are permitted to invest in the shares. As the shares are being inherited from an Indian resident, the shares will be held on non-repatriable basis. Under schedule IV of NDI rules, NRIs and OCIs can invest on non-repatriable basis. Hence inheritance is permitted on non-repatriable basis.

In some sectors such as agricultural activities, NRIs and OCIs cannot invest. If NRI / OCI inherit shares of a company engaged in agricultural activities, the agricultural activity has to stop. At times it is impractical to abruptly stop the activities. In such a situation, one must approach RBI for its directions. Quite likely RBI may direct the NRI to divest the shares if agricultural activities have to continue.

Shares can be sold as permitted under the NDI rules.

NRIs can repatriate upto US$ 1 mn. per year as stated in para 2.2.2.

2.3.3 Under Schedule IV of NDI rules, incorporated foreign entities which are owned and controlled by NRI/OCI, can also invest on non-repatriable basis. Hence if such an entity is the heir, it can inherit the shares in Indian companies.

Heir company can sell the shares as permitted under NDI rules.

However such entities cannot repatriate the funds outside India. This is one gap in FEMA rules. RBI has not made any rules for such companies owned and controlled by NRIs / OCIs inheriting assets from Indian residents. One can apply to RBI. However it is doubtful whether RBI will approve such a remittance. Otherwise there will be no difference between repatriable and non-repatriable investment in substance.

Practical way out for the testator will be to avoid making a bequest to such companies & others where law is absent. This issue assumes importance in some cases. NRIs living in countries where Inheritance Tax is applicable want their parents to bequeath their estate to the companies or trusts settled by NRIs. It will be difficult.

Further Trust is an unincorporated entity. Unincorporated entities are not eligible to invest. For this reason also, the Trust cannot inherit.

2.3.4 Non-resident entity and foreigner (Not NRI/OCI) – If an heir is a foreign entity, or an outright foreigner, it can inherit the shares. However it will have to obtain an approval from DPIIT to hold the shares. This is because foreigners are permitted to invest on repatriable basis. They cannot invest on non-repatriable basis.

Here the testator is an Indian resident and no foreign exchange has come in India for the investment. Hence heirs cannot hold shares on repatriable basis. This is a rare situation where shares will be held on non-repatriable basis by a foreigner.

For sale and repatriation of sale proceeds, again an approval from RBI is required. It is difficult to envisage whether RBI will permit repatriation os sale proceeds. It is preferable to avoid such situation.

2.4 Mutual funds, Debt and other instruments:

2.4.1 a) NRI and OCI – NRI and OCI are permitted to invest in following securities on repatriable basis under NDI rules:

- Units of mutual fund which invest more than 50% in equity.

- shares in public sector enterprises which are divested by the Government.

- Subscription to National Pension Scheme.

- units of investment vehicle (Alternative Investment Funds).

- Capital in LLP

- Convertible Note of start ups.

- Depository receipts.

b) NRI and OCI are also permitted to invest in following debt instruments on repatriable basis under Debt Instrument rules.

- Government dated securities (other than bearer securities) or treasury bills or units of domestic mutual funds or

- Exchange-Traded Funds (ETFs) which invest less than or equal to 50 percent in equity;

- Bonds issued by a Public Sector Undertaking (PSU) in India;

- Bonds issued by Infrastructure Debt Funds;

- Listed non-convertible/ redeemable preference shares or debentures issued on account of merger or demerger of an Indian company in terms of Regulation 6 of these Regulations;

- debt instruments issued by banks, eligible for inclusion in regulatory capital.

c) NRI and OCI are also permitted to invest in following debt instruments on non-repatriable basis under Debt Instrument rules.

- Dated Government securities (other than bearer securities), treasury bills

- units of domestic mutual funds or Exchange-Traded Funds (ETFs) which invest less than or equal to 50 percent in equity,

- National Plan/ Savings Certificates.

- Listed non-convertible/ redeemable preference shares or debentures issued on account of merger or demerger of an Indian company in terms of Regulation 6 of these Regulations;

- Chit funds authorised by the Registrar of Chits or an officer authorised by the State Government in this behalf.

2.4.2 If the Indian resident holds the above investments, the NRI and OCI can inherit the above investments on non-repatriable basis.

Securities mentioned in para 2.4.1(a) can be sold. Securities (Debt instruments) mentioned in para 2.4.1(b) and 2.4.1(c) can be sold if these are purchased. If these Debt instruments are inherited, for sale, there is no specific approval given under the rules. As a practice, sale is permitted.

Remittance upto US$ 1 mn. per year is permitted.

2.4.3 If there are any other kinds of investments, an approval will be required to hold the assets on inheritance. For sale also an approval will be required. Remittance upto US$ 1 mn. per year is permitted.

2.5 Loans and deposits:

Under some circumstances, NRIs can give a loan and place deposits on non-repatriable basis. If the NRI / OCI inherits such loan and deposits which the NRI could have given, then they can hold on to the loans on inheritance.

If these do not fall within the permitted, it is better to take approval from RBI.

2.6 Bank accounts:

NRI / OCI can have NRO bank accounts in India. Hence on inheritance, they can hold on to the funds. The testator would have a resident rupee account. The NRI / OCI heir will have NRO account.

Kindly note that there is no specific approval given for inheritance of bank accounts. However inheritance is permitted as a practice. This another gap in the provisions, but permitted in practice.

2.7 Other assets such as gold, bullion, jewellery, paintings, etc.:

FEMA regulates foreign exchange, investments, loans, deposits, bank accounts and immovable property. It does not specifically regulate assets such as gold, bullion, paintings, etc.

Non-residents can purchase gold, Jewellery, etc. in India and keep it in India itself. They can bring the gold and Jewellery from abroad also. There is no bar on holding precious Jewellery and stones. This is by way of practice and not as per any specific rules.

At the same time, if a non-resident proposes to hold these assets, it will amount to Capital Account Transaction.

As a practice, if an NRI / OCI inherits these assets, they can hold assets on inheritance.

He can sell the assets also and repatriate the funds under US$ 1 mn. scheme.

Can the NRI take away from India gold and jewellery which he acquired on inheritance? Under Customs Baggage Rules, there is no limit on taking out personal jewellery which can be considered as personal baggage. FEMA does not provide any guidance. There is no specific bar under FEMA. At the same time if the NRI wants to take away jewellery etc. worth more than US$ 1 mn., it will amount to taking away more than what is permitted under the US$ 1 mn. scheme. Theoretically the NRI heir can purchase jewellery of more than US$ 1 mn. and take away physically while going abroad.

In my view if the NRI wants to take away jewellery exceeding US$ 1 mn. (including funds remitted under this scheme), an application should be made to RBI. If the amount is less than US$ 1 mn., consider it as a part of US$ 1 mn.

2.8 Holding Indian assets in an Indian company - As discussed above, in some situations, it is possible for heirs to hold Indian shares. Wherever possible, assets in India, can be transferred to the Indian company by the testator. Shares of such Indian company can be held by the heirs – especially NRI / OCI / PIO heirs. There are however several laws in India which one has to consider. Income-tax implications, NBFC rules, Company law, LLP, stamp duty, etc. have to be considered.

3. Testator is an Indian resident, has foreign assets and resident heirs:

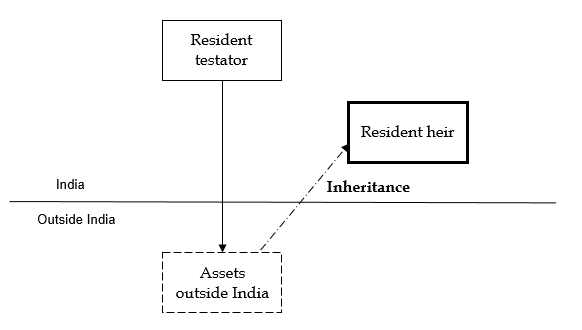

3.1 As an illustration, let us consider Mr. Vishal Batra an Indian resident parent who has various assets outside India. His children (heirs) are Indian residents. On the death of the parent, his children inherit the assets. Assets are of several kinds –immovable property, shares, gold etc. A simple chart is given below.

3.2 Immovable property:

The testator could have acquired property abroad in any of the following manners.

- Funds sent under LRS.

- Gift or inheritance from Returning India – u/s. 6(4).

- Purchase of property from RFC account funds.

3.2.1 An Indian resident can bequeath IP to anyone. If an Indian resident inherits the foreign IP, can he retain it?

There are multiple regulations. Notification no. 7(R) - Foreign Exchange Management (Acquisition and transfer of immovable property outside India) Regulations, 2015, deals with IP abroad by Indian residents.

Under regulation 5(2) of Notification 7(R), an Indian resident (heir) can inherit and hold the property, if the testator had acquired the property as per FEMA law. Thus Mr. Batra may have acquired the property in any permitted manner. His heir can inherit the same and retain it. Thus IP acquired under LRS or from funds under RFC account by the testator, can be inherited by the resident heir. Under this provision, the property can pass on from one heir to another.

This is a big relief. Normally if an Indian resident acquires any foreign asset, he is required to bring the funds in India, or sell the property / assets and bring the funds in India. In the erstwhile Notification no. 7 (repealed from 21st January 2016), this relief was not there.

Today several Indian residents have invested in IP abroad under the LRS. If the person expires, and the heir has to sell and bring the proceeds to India, it causes a lot of difficulty. This is a welcome provision.

[RFC account can be opened by a Returning Indian. Funds which he had earned / accumulated while he was a non-resident can be deposited in this account. See para 4(B) of Foreign Exchange Management (Foreign currency accounts by a person resident in India) Regulations, 2015 - Notification No. FEMA 10 (R) /2015-RB January 21, 2016. Relief for RFC account are applicable for all assets and not just IP.]

3.2.2 Regulation 5(1)(a) of Notification 7(R) provides for more relief. It provides that if the testator was a non-resident and had acquired the property while he was a non-resident, on return to India, such a person can retain the IP. [S. 6(4) of FEMA]. (Such person is referred to as Returning Indian.) If the heir inherits IP from a such a Returning Indian, he can retain he same abroad. Thus in our illustration above, if Mr. Batra had acquired the property outside India while he was a non-resident, his children can inherit the property.

In case of Returning Indians, u/s. 6(4) of FEMA, heir of heir cannot hold the IP abroad. However under Reg. 5(2) of Notn. 7(R), heir of heir can retain the IP abroad.

3.2.3 The objective of section 6(4) (Returning Indian) and 6(5) (emigrating Indian) is that people who change their residence, should be able to continue to – hold the asset, transfer the asset, retain the sale proceeds and reinvest the same. One may note that sections 6(4) and 6(5) deal with broad category of assets – currency, security, immovable property, etc. See para 3.2.4 for more details on Returning Indian. See paras 6.2.2 and 6.2.3 for more details on “emigrating Indian”.

Prior to 2016, this relief was the only one available. However now relief provided under R. 5(2) of Notn. 7(R) is sufficient as far as IP is concerned. For other assets, relief under Section 6(4) of FEMA becomes relevant. See paras below for other assets.

3.2.4 The language of the section 6(4) is confusing. It appears that an Indian resident can inherit assets if these are inherited from a non-resident. However that is not the interpretation. The correct interpretation is that a resident heir can inherit and hold the foreign IP from a Returning Indian (who is an Indian resident at the time of death).

The background of this is the circulars and notifications issued under erstwhile Foreign Exchange Regulation Act in 1992 and 1995 providing relief to Returning Indians. The circular and notifications run into several pages under FERA. It was quite clear that inheritance should be from an Indian resident (who was a non-resident when IP was acquired). Under FEMA this relief has been shrunk to 4 lines. Hence it gives rise to incorrect interpretation.

After representations were made, RBI has issued AP circular 90 dated 9th Jan 2014 to clarify further section 6(4). Though it does not resolve all the issues, it brings out the purpose of S. 6(4).

In this article I am not going into the details. Interested readers may visit our website for more details.

In essence, if heir acquires IP u/s. 6(4), then IP can be retained or sold by the heir. Sale proceeds can be invested in any manner as the person likes.

If however IP is inherited in any other manner, or inherited from a non-resident, the IP has to be sold and funds have to be brought into India.

3.3 Shares and securities:

Indian resident can acquire foreign shares and securities under various situations as under:

-

While the person was a non-resident, he acquired shares and securities. Later he shifted to India and became an Indian resident (known as Returning Indian).

-

He invested in the securities under the Liberalised Remittance Scheme.

-

He invested in a Joint Venture or Wholly Owned subsidiary abroad (considered as Overseas Direct investment) for undertaking business.

-

Purchase of property from RFC account funds.

There are no specific rules for inheritance of shares and securities. Let us consider the above situations below.

3.3.1 The first situation is of Returning Indian. Under section 6(4), a person (Mr. Batra - parent) who comes and becomes an Indian resident, can continue to hold the assets abroad. See paras 3.2.2 to 3.2.4 for discussion on Returning Indian.

Further, his son (heir) who is also an Indian resident, can inherit the property and hold it.

Once the heir receives the shares and securities, his heir (i.e. heir of heir) cannot hold the assets. The testator who is the original owner of the securities, can sell the same and reinvest the proceeds. The heir also can retain the sale proceeds abroad and reinvest abroad. However heir of heir has to bring back the assets / sale proceeds.

3.3.2 The second situation is that of securities invested under the Liberalised Remittance Scheme by the testator.

Under Reg. 22(1)(iii) of FEMA Notification no. 120, the Indian resident heir (individual) can inherit the securities from a resident (other than Returning Indian). Thus the heir can hold the foreign securities. Heir of heir can also hold the shares.

If securities are sold, funds have to be remitted to India. If the heir is not an individual, the securities cannot be held without approval from RBI.

Under Reg. 22(4), an individual can sell such shares. (There is an error in Regu. 22(4). The Reg. refers to sale of shares which have been acquired under sub-reg. (2) and (3). By error, sub-reg. (1) has been missed out.

The Master direction makes this clear in para C.1(2).

It should be noted that under FEMA notification 120, any foreign “security” can be inherited. The Master Direction on Joint Ventures abroad refers to foreign “shares” which can be inherited.

Master Directions are directions to the banks. These lay down the modalities as to how the foreign exchange business has to be conducted by the Authorised Persons with their customers/ constituents with a view to implementing the regulations framed. Master Directions cannot give an interpretation of its own. Notification is the law. Hence inheritance of any foreign security is permitted. Such securities can be held on inheritance.

On sale of such shares, the proceeds cannot be retained abroad by the heir. These have to be remitted into India.

3.3.3 The third situation is that of securities invested under Overseas Direct Investment regulations by the testator.

The rules for inheritance are same as that discussed in para 3.3.2 above. I.e. Heir can inherit the securities and hold the same.

On sale of shares, the funds have to be brought into India.

As the securities are originally acquired under the Overseas Direct Investment route (Notification no. 120), all the formalities should be complied with. The name of the heir should be recorded as the owner. One has to file the necessary information to the bank which will liaise with RBI for change of name.

3.3.4 The fourth situation is where the securities are acquired from funds in RFC account by the testator.

As discussed above, under Regu. 22(1)(iii) of FEMA Notification no. 120, an individual can inherit foreign shares from a resident. Heir of heir can also inherit the shares.

On sale of shares by the heir, the funds have to be brought into India.

3.4 Bank account funds and foreign currency:

Indian resident can maintain funds in foreign bank accounts under various situations. These situations could be:

-

While the person was a non-resident, he had accumulated the funds in bank account. Later he shifted to India and became an Indian resident (known as Returning Indian). This wealth can be funds in bank accounts and foreign currency. (This situation includes a situation where a person has funds in RFC account and he remits abroad from this RFC account.)

-

He remitted the funds under the Liberalised Remittance Scheme. Under LRS, an individual can hold funds in a foreign bank account. It may be noted that a person can hold funds in a foreign bank account but is not specifically permitted to hold foreign currency

3.4.1 The first situation is of Returning Indian. This has been discussed in paras 3.2.2 to 3.2.4 above. Under section 6(4), the Indian resident heir can inherit the bank funds and hold it. Funds can be used for acquiring any other assets outside India.

Under Regulation 4 of Foreign Exchange Management (Foreign currency accounts by a person resident in India) Regulations, 2015 - Notification No. FEMA 10(R) /2015-RB dated January 21, 2016 an Indian resident can open a Resident Foreign Currency Account (RFC) with an Indian bank. The funds in the account can be received from funds abroad by a Returning Indian.

An Indian resident can also receive the funds as gift or inheritance from a Returning Indian.

3.4.2 The second situation is that of funds remitted in the foreign bank account under the Liberalised Remittance Scheme by the testator.

Here there is no permission provided to retain the funds abroad as in case of shares. If the Indian resident heir inherits bank funds, he has to bring it in India.

Reg. 3 of Foreign Exchange Management (Realisation, repatriation and surrender of foreign exchange) Regulations, 2015 (Notification 9(R)) – It provides that any resident to whom any foreign exchange is due or has accrued, has to take all reasonable steps to realise and repatriate to India such foreign exchange.

He should not in any case do or refrain from doing anything, due to which receipt of foreign exchange is delayed, or the foreign exchange ceases in whole or in part to be receivable by him.

Under Reg, 4(1)(a) of the above referred regulation [Notification 9(R)], on realisation of foreign exchange, the person has to bring the same in India and sell the same to the bank.

Hence the heir has to bring back the funds into India.

3.4.3 There could however be a situation where deposits are for a particular period. A few years are left before the deposit can be encashed. In such a situation, one cannot bring back the funds.

In such a situation, the heir should apply to RBI to allow one to hold the deposits till maturity. On maturity of the deposit, the amount should be brought back. Of course if one can encash the deposits, then RBI will generally not approve of holding the deposits abroad.

3.4.4 Under Reg. 3(iii) of Foreign Exchange Management (Possession and Retention of Foreign Currency) Regulations, 2015 - Notification No. FEMA 11(R)/2015-RB December 29, 2015, an Indian resident can retain foreign coins without limit.

This is practically insignificant.

3.4.5 FEMA rules also permit an Indian resident to hold foreign exchange abroad which is acquired before 8th July 1947 in terms of general or specific approval. Income on such accounts is also permitted to be held abroad. [S. 9(c) of FEMA].

An Indian resident heir is also permitted to hold foreign exchange in RFC account which is received from funds referred to in S. 9(c) of FEMA. There are however very rare cases. Hence it is not discussed further.

3.5 Loans:

Loan can be given under two situations as under:

-

While the person was a non-resident, he had given loan to a non-resident. Later he shifted to India and became an Indian resident (known as Returning Indian). (This situation includes a situation where loan is given from RFC account.)

-

He remitted the funds under the Liberalised Remittance Scheme.

3.5.1 The first situation is of Returning Indian. This has been discussed in paras 3.2.2 to 3.2.4 above. Under section 6(4), the Indian resident heir can inherit the loan funds and hold it.

3.5.2 The second situation is that of loan given under the Liberalised Remittance Scheme by the testator.

Consequences of this situation is the same as in para 3.4.2. If the Indian resident heir inherits loans, he has to bring it in India.

3.5.3 Here also there could be a situation where loan has been given for a particular period. A few years are left before the lender can insist on repayment. In such a situation, one cannot bring back the funds. In such a situation, the heir should apply to RBI to allow one to hold the loan till maturity. On maturity of the loan, the amount should be brought back. Of course if one can realise the loan before maturity, then RBI will generally not approve of holding the loan abroad.

3.6 Other assets – including gold, jewellery, paintings etc.:

3.6.1 Apart from assets discussed above, FEMA does not have any specific regulations to regulate any other assets. Does it mean that FEMA does not apply to other assets? This is a difficult question.

The reason is that “Capital Account Transaction” u/s. 2(e) provides that transaction which alters the assets and liabilities of a non-resident in India, or alters the assets and liabilities outside India of an Indian resident is a capital account transaction.

Sections 4 & 8 together apply to every Indian Resident. The testator could have acquired gold under old LRS rules. (Under current rules, gold cannot be acquired under LRS.) All foreign assets inherited by an IR should be brought back into India; or apply to RBI to retain abroad.

Gold, jewellery, paintings are covered within the definition of Capital Account Transaction. There are however no rules.

Can one take a view that there is no prohibition on such assets? So far to the best of my knowledge RBI does not want to regulate such assets. Yet to take a view that FEMA does not apply will not be a correct interpretation.

If the value of gold, jewellery and other assets are large, it will be better to apply to RBI for an approval to hold the assets abroad.

3.6.2 I have discussed above the permission granted to Returning Indians to maintain their assets outside India (S. 6(4)).

Even in 1992 and 1995, while the rules permitted Returning Indians to keep their assets abroad, it did not refer to assets such as gold, etc. Those rules only covered securities, immovable property etc.

Can one take a view that gold etc. can be kept abroad? In my view it is not permitted. One should obtain an approval from RBI. Or bring the assets into India.

3.6.3 Under LRS, an Indian resident is not specifically permitted to acquire gold, jewellery, etc. Hence inheritance in such situation does not arise.

However when LRS was introduced, there was no specific restriction on acquiring gold, etc. The testator could have acquired the assets under LRS as it stood at that time. In such situation, heir has to bring back the assets into India.

3.7 Holding foreign assets in foreign company - As discussed above, in some situations, it is possible for heirs to hold foreign shares. Wherever possible, assets outside India, can be transferred to the foreign company by the testator. Shares of such foreign company can be held by the heirs. One of course has to consider tax implications and any other applicable laws. If for example, a non-resident transfers foreign assets to a foreign company just before returning to India, tax anti-avoidance rules will apply. Section 93 of Income-tax Act should be considered.

4. Testator is an Indian resident, has foreign assets and non-resident heirs:

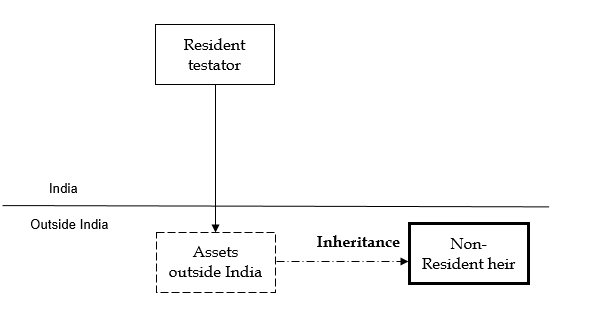

4.1 As an illustration, consider Mr. Rajiv Patel an Indian resident parent has various assets outside India. His children (heirs) are non-residents. On the death of the parent, non-residents inherit the assets. Assets can be of several kinds –immovable property, shares, gold etc. A simple chart is given below.

4.2.1 Immovable property:

The testator could have acquired property abroad under any of the following manners.

- Funds sent under LRS.

- Gift or inheritance from Returning Indian – u/s. 6(4).

- Purchase of property from RFC account funds.

4.2.2 IP acquired under LRS can be bequeathed to a non-resident. Once the non-resident heir inherits the IP outside India, the IP goes out of the jurisdiction of FEMA.

IP acquired through other means as stated above, can also be inherited by the non-resident. As above, once the IP is inherited by the non-resident heir, it goes out of the jurisdiction of FEMA. The heir can deal with the IP as he considers appropriate.

Thus Mr. Patel’s heirs will be able to enjoy the assets smoothly.

4.3 Shares and securities:

Indian resident can acquire foreign shares and securities acquired under various situations. These situations could be:

-

While the person was a non-resident, he acquired shares and securities. Later he shifted to India and became an Indian resident (known as Returning Indian).

-

He invested in the securities under the Liberalised Remittance Scheme.

-

He invested in a Joint Venture or Wholly Owned subsidiary abroad (considered as Overseas Direct investment) for undertaking business.

-

Purchase of property from RFC account funds.

There are no specific rules for inheritance of shares and securities. Let us consider the above situations below.

4.3.1 The first situation is of Returning Indian. Under section 6(4), a person (parent) who comes and becomes an Indian resident, can continue to hold the assets abroad.

There are no restrictions on dealing with such securities. The resident can bequeath the property to non-resident heir. The non-resident heir can inherit such securities. Once the assets are inherited by the non-resident heir, these go out of the jurisdiction of FEMA. The heir can deal with the shares and securities as he considers appropriate.

4.3.2 The second situation is that of securities invested under the Liberalised Remittance Scheme by the testator.

For assets acquired under LRS, there is no restriction on dealing with these securities. The non-resident heir can inherit such securities. Once the assets are inherited by the non-resident heir, these goes out of the jurisdiction of FEMA. The heir can deal with the shares and securities as he considers appropriate.

4.3.3 The third situation is that of securities invested under Overseas Direct Investment regulations.

There is no specific rule for such bequests and inheritance. Normally for investment under Overseas Direct Investment regulations, as long as the business is being conducted, the Indian resident can hold the assets. If business is closed, or the shares of the foreign entity are sold, the proceeds have to come to India.

In case of inheritance by the non-resident heir, one should apply to RBI for approval to inherit and hold on to the foreign securities.

4.3.4 In the fourth situation, Indian resident can bequeath securities to a non-resident. Once the non-resident inherits the securities, these go out of FEMA jurisdiction. The heir can deal with the shares and securities as he considers appropriate.

4.4 Bank account funds and foreign currency:

Indian resident can maintain funds in foreign bank accounts under various situations. These situations could be:

-

While the person was a non-resident, he had accumulated the funds in bank account. Later he shifted to India and became an Indian resident (known as Returning Indian).

-

He remitted the funds under the Liberalised Remittance Scheme. Under LRS, an individual can hold funds in a foreign bank account. It may be noted that a person can hold funds in a foreign bank account but is not specifically permitted to hold foreign currency abroad.

-

Funds were remitted from RFC account.

4.4.1 The first situation is of Returning Indian. Under section 6(4), a person (parent) who comes and becomes an Indian resident, can continue to hold the assets abroad.

The resident can bequeath the property to non-resident heir. The non-resident heir can inherit such funds. Once the assets are inherited by the non-resident heir, it goes out of the jurisdiction of FEMA. The heir can deal with the funds as he considers appropriate.

4.4.2 The second situation is that of funds invested under the Liberalised Remittance Scheme by the testator.

For assets acquired under LRS, there is no restriction on dealing with these funds. The non-resident heir can inherit such funds. Once the funds are inherited by the non-resident heir, these goes out of the jurisdiction of FEMA. The heir can deal with the funds as he considers appropriate.

4.4.3 In the third situation, Indian resident can bequeath bank funds and foreign currency to a non-resident. Once the non-resident inherits the bank funds and foreign currency, these go out of FEMA jurisdiction. The heir can deal with the bank funds and foreign currency as he considers appropriate.

4.4.4 Refer to para 3.4.4 for retention of foreign coins.

4.5 Loans:

Loan can be given under two situations as under:

-

While the person was a non-resident, he had given loan to a non-resident. Later he shifted to India and became an Indian resident (known as Returning Indian).

-

He remitted the funds under the Liberalised Remittance Scheme.

-

Funds were remitted from RFC account.

4.5.1 The first situation is of Returning Indian. This has been discussed in para 4.4.1 above. The non-resident heir can inherit the loan funds and hold it. Once the assets are inherited by the non-resident heir, these goes out of the jurisdiction of FEMA. The heir can deal with the loans as he considers appropriate.

4.5.2 The second situation is that of loan given under the Liberalised Remittance Scheme by the testator.

Consequences of this situation is the same as in para 4.4.2. The non-resident heir can inherit the loan funds and hold it. Once the assets are inherited by the non-resident heir, these goes out of the jurisdiction of FEMA. The heir can deal with the loans as he considers appropriate.

4.5.3 In the third situation, Indian resident can bequeath loan to a non-resident. Once the non-resident inherits the loan, it goes out of FEMA jurisdiction. The heir can deal with the loan as he considers appropriate.

4.6 Other assets such as gold, bullion, jewellery, paintings, etc.:

As discussed in para 3.6.1, FEMA does not have any specific regulations to regulate any other assets. These are however assets covered under FEMA in the definition of Capital account transaction.

Indian resident can hold such assets under the following situation.

-

While the person was a non-resident, he had accumulated the funds in bank account. Later he shifted to India and became an Indian resident (known as Returning Indian).

-

He remitted the funds under the Liberalised Remittance Scheme.

-

Funds were remitted from RFC account.

4.6.1 In case of Returning Indian, under section 6(4), a person (parent) who comes and becomes an Indian resident, can continue to hold the assets abroad.

The resident can bequeath the property to non-resident heir. The non-resident heir can inherit such funds. Once the assets are inherited by the non-resident heir, it goes out of the jurisdiction of FEMA. The heir can deal with the these assets as he considers appropriate. See paras 3.6.1 and 3.6.2 for issues relating to Returning Indian.

4.6.2 Under LRS, an Indian resident is not specifically permitted to acquire gold, jewellery, etc. Hence inheritance in such situation does not arise. However under old LRS rules, gold could be acquired. In this situation, the heir can inherit gold. Once the assets are inherited by the non-resident heir, these goes out of the jurisdiction of FEMA. The heir can deal with the loans as he considers appropriate.

4.6.3 In the third situation, Indian resident can bequeath assets to a non-resident. Once the non-resident inherits the assets, these go out of FEMA jurisdiction. The heir can deal with the shares and securities as he considers appropriate.

5. Testator is a non-resident, has Indian assets and resident heirs:

5.1 As an illustration consider Mr. Poojari, a non-resident parent has various assets in India. His children (heirs) are Indian residents. On the death of the parent, residents inherit the assets. Assets can be of several kinds –immovable property, shares, gold etc.

5.2 Immovable Property (IP):

Only NRIs and OCIs are allowed to acquire IP in India. Only in rare situations where a foreigner (Non-NRI/Non-OCI) has become an Indian resident, he can acquire IP in India. The foreigner can hold on to the IP in India when he returns to his home country.

There is no specific provision for inheritance by resident heirs. There is a provision for inheritance by the NRI/OCI but not by a resident.

However acquisition of property in India by an Indian resident is not a Capital Account transaction. Hence inheritance of IP in India by a resident heir from non-resident testator has always been permitted. The principle is that if an asset is coming under the ownership of Indian resident, it is permitted.

The closest provision is R. 24(d) of NDI rules. It provides that a NRI / OCI can transfer any immovable property in India to a person resident in India. Transfer is permitted. Transmission is not specified. Prima facie it seems, this should be a permissible transaction.

Under R. 31, a citizen of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Hong Kong, Macau, Nepal, Bhutan and Democratic People’s Republic of Korea (DPRK) is not allowed to acquire immovable property without RBI approval. It is a debatable whether this rule is ultra-vires. See para 2.2.3(b).

5.3 Other assets:

There is no specific provision for inheritance at all for any other asset. As a principle an Indian resident can receive any assets in India as inheritance. Hence inheritance is permitted. Capital Account transaction is defined as “a transaction which alters the assets or liabilities…outside India … of an Indian resident”.

When an Indian resident inherits Indian asset from anyone, the transaction will not be a Capital account transaction. Hence FEMA does not apply.

Non-resident testator would have invested under specific rules. For example, the non-resident may have invested under NDI rules. On inheritance by the resident heir, the foreign investment registration number will have to be cancelled. One can do so through the bank for this.

6. Testator is a non-resident, has Indian assets and non-resident heirs:

6.1 As an illustration, consider Mr. Shah a non-resident parent has various assets in India. His heirs are non-residents. On the death of the parent, non-residents inherit the assets. Assets can be of several kinds –immovable property, shares, gold etc.

6.2 Immovable Property:

The testator could have acquired property in India under any of the following manners.

- Funds remitted to India.

- Gift or inheritance from emigrating resident – u/s. 6(5).

- While he was an Indian resident.

6.2.1 As mentioned above, only NRIs and OCIs are allowed to buy IP in India. They can bequeath IP to anyone. In some rare cases, foreigners (Non-NRI/Non-OCI) may have acquired the IP. See para 5.2 above.

If the heir is an NRI or OCI, no approval is required to inherit the IP.

As per Rule 24(c)(i) of NDI rules - Acquisition and transfer of property in India by a NRI or an OCI - A NRI or an OCI may -

(c) acquire any immovable property in India by way of inheritance from a person resident outside India who had acquired such property:-

(i) in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of these rules.

Thus an NRI / OCI can inherit the property. They can hold the IP. Later they can also sell the property as permitted in the rules. Funds can also be remitted abroad under US$ 1 mn. scheme.

The testator who had acquired the property with foreign exchange remitted to India, can take away entire sale proceeds. However there is no clarity in case of the heir. In essence the IP is a repatriable asset in the hands of testator. Whether the IP can continue as a repatriable asset in the hands of the heir, is not clear. If more than US$ 1 mn has to be remitted, an approval form RBI should be taken.

6.2.2 If the heir is not an NRI or OCI, an approval of RBI is required to hold on to the IP. For sale of that IP & for remittance of sale proceeds net of tax, again an approval is required.

If inheritance is from a non-resident u/s. 6(5), upto US$ 1 mn. can be repatriated. [Notn. 13(R), Reg. 4(1)(ii)]. (See para 6.2.3 below for discussion on S. 6(5)). For remittance of more funds, the heir of an emigrating Indian, requires approval to repatriate the funds. [Section 29(1) of NDI rules.] (However if the emigrating Indian wants to remit funds on sale of IP, approval is required.)

Section 6(5) permits a non-resident to hold on to Indian security, Indian currency and Immovable property in India if he had acquired when he was an Indian resident. Such a person is referred to as “emigrating resident” in this article. A non-resident can inherit the assets from an “emigrating resident”.

Legally what is permitted to be inherited, are only three assets – immovable property, Indian security and Indian currency.

Other assets are not covered.

Under section 6(4) (Returning India), there is an explanatory circular [AP 90 of 2014] which has elaborated as to what all assets can section 6(4) apply to. Such a clarification is not there in case of section 6(5). The objective of section 6(4) and 6(5) is that people who change their residence, should be able to continue to – hold the asset, transfer the asset, retain the sale proceeds and reinvest the same.

Section 6(5) refers only to three assets. However in practice the non-resident is permitted to hold several assets when he emigrates abroad. There is of course no specific provision for loans, gold, Jewellery etc.

6.2.3 Under section 6(5), a non-resident can hold the IP which he would have acquired while a resident in India. Subsequently the person becomes a non-resident.

Such property can be bequeathed to another non-resident.

There is no distinction between NRI/OCI and a foreigner. An outright foreigner can acquire the property. The property can be sold subsequently.

If inheritance is from a non-resident u/s. 6(5) (emigrating Indian), upto US$ 1 mn. can be repatriated. [Notn. 13(R), Reg. 4(1)(ii).]

If foreigner inherits property in any other manner, he cannot remit funds out of India without an approval from RBI.

A widow/ widower resident outside India who has inherited assets of the deceased spouse who was an Indian citizen resident in India, can remit upto USD 1,000,000 (US Dollar One million only) per financial year.

6.3 Other assets:

There is no specific provision for inheritance of other assets. Other assets can be of several kinds – gold, Jewellery, paintings, etc.

6.3.1 One may say that if the heir is permitted to own the assets in India, then there is no difficulty in inheriting such kind of assets. For example, if a foreigner has invested in equity shares under the FDI rules, then the heir can inherit the shares. Transfer of shares from non-resident to non-resident is permitted under automatic route. Hence inheritance also should be permitted. However for assets referred to in para 6.3 above, there are no rules. An NRI inheriting assets within India is a capital account transaction. Hence without approval, technically such assets cannot be held.

If heir is not eligible to own the property, an approval of RBI will be required to hold the property acquired in inheritance. For example, this can be the situation in case of non-resident being from the country which has land border with India. In April 2020 Indian Government passed regulations that any investment from a country which has land border in India, will require prior approval. In such cases the heir will require approval from Indian Government.

For sale and remittance of funds abroad, an approval is required.

6.3.2 What has been stated above in para 6.2.3, applies for Indian security and Indian currency. [S. 6(5)]

Thus NRI/OCI and foreigner can inherit the above assets.

6.3.3 Bank accounts in India – Non-residents can hold Special Non-Resident Rupee Account (SNRR) and NRO bank accounts in India. NRIs and PIOs can hold NRE and FCNR bank accounts in India. Nomination can be made for these accounts. In case of death of account holder, regulations provide for nomination under Deposit Regulations [Notn. 5(R)] as under:

-

NRE account – Schedule 1, clause 8 – Funds can be remitted to the non-resident nominee.

-

NRE account – Schedule 1, clause 9(f) – If the resident is a nominee and he has to remit funds for meeting liabilities or similar purpose, an application has to be made to the RBI.

-

FCNR(B) account – Schedule 2, clause 11(1) – Rules applicable for NRE account for repatriation, etc. apply to FCNR(B) account. Thus what is stated in i) and ii) above applies to FCNR(B) account also.

-

NRO account – Schedule 3, clause 10 – Funds can be credited to the NRO bank account of the non-resident nominee.

-

SNRR account – Schedule 4, clause 13 – Funds can be credited to NRE / NRO account of the non-resident nominee or can be remitted abroad through normal banking channels.

However nomination is different from inheritance. The testator may have made one person as the nominee and someone else as the heir. The funds belong to the heir. Hence the nominee who gets the funds, is required to hand it over to the heir. Nomination only eases the dealings with the bank.

6.4 For holding Indian assets under an Indian company, see para 2.8 above.

7. Testator is a non-resident, has foreign assets and resident heirs:

7.1 As an illustration consider Mr. Agarwal a non-resident parent has various assets outside India. His children (heirs) are Indian residents. On the death of the parent, residents inherit the assets. Assets can be of several kinds –immovable property, shares, gold etc.

7.2 Immovable property:

If an Indian resident inherits IP abroad from a non-resident, he has to sell it off and bring the proceeds in India. There is no relief. A person may apply to RBI to hold on the property. However RBI is not likely to approve the holding of the IP abroad.

7.3 Shares and securities:

Under Reg. 22(1)(iii) of FEMA Notification no. 120, an individual resident can inherit foreign shares from a non-resident.

Under Reg. 22(4), an individual can sell such shares. Funds have to be repatriated to India. (There is an error in Reg. 22(4). The reg. refers to sale of shares which have been acquired under sub-reg. (2) and (3). By error, sub-reg. (1) has been missed out.)

The Master direction makes this clear in para C.1(2).

For more details, please see para 3.2.2.

7.4 Other assets:

Any foreign asset inherited by a resident has to be sold off and proceeds have to be brought into India. If there is any difficulty, it is better to apply to RBI for directions.

7.5 Shares under ODI route – a peculiar situation:

An Indian resident could have acquired shares of a company outside India under the Overseas Direct investment route (referred to LRS-ODI route). Under this situation, RBI grants a Unique Identification Number. The Indian resident has to file Annual Performance Report every year and in general comply with the FEMA rules for the investment.

When the resident becomes a non-resident, does FEMA continue to apply? Legally the person (who becomes a non-resident), and the shares are outside India. FEMA should not apply. However RBI has taken a view that one may write to RBI and then it will give its view.

If the non-resident shareholder bequeaths the shares to an Indian resident, no approval is required (see para 7.3). If the shares are bequeathed to a non-resident, direction from RBI will be required.

7.6 For holding foreign assets under a foreign company, see para 3.7 above.

8. Legal proceedings:

Section 43 provides for devolving of rights etc. on the legal representative. Any right, obligation, liability, proceeding or appeal will not abate due to death or insolvency of the person. Upon such death or insolvency, the rights and obligations will devolve on the legal representative of such person or the official receiver or the official assignee, as the case may be:

The legal representative of the deceased shall be liable only to the extent of the inheritance or estate of the deceased.

9. End Note – The FEMA rules are quite confusing as the reader would have noticed. Simplification is much desired. A better situation will be to scrap several rules and keep only limited rules.

The article deals with the issues in a legal manner. It is possible that some issues may have been missed out. The article is not a legal opinion. Those facing issues of bequests and inheritance, should obtain legal advice.

Annexure A

Extracts of FEMA law – Act, Rules and Regulations providing for inheritance in case of resident heir

1. Foreign Exchange Management Act (FEMA):

1.1.1 Section 6(4) – Capital Account Transactions:

A person resident in India may hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India if such currency, security or property was acquired, held or owned by such person when he was resident outside India or inherited from a person who was resident outside India.

1.1.2 A.P. (DIR Series) Circular No. 90 January 9, 2014:

Attention of Authorized Dealers is invited to Section 6 (4) of FEMA, 1999 in terms of which a person resident in India may hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside India if such currency, security or property was acquired, held or owned by such person when he was resident outside India or inherited from a person who was resident outside India.

2. We have been receiving representations with regards to nature of transactions covered under Section 6(4) of FEMA, 1999. In this regard it is clarified that Section 6(4) of FEMA, 1999 covers the following transactions:

(ii) Income earned through employment or business or vocation outside India taken up or commenced while such person was resident outside India, or from investments made while such person was resident outside India, or from gift or inheritance received while such a person was resident outside India;

(iii) Foreign exchange including any income arising therefrom, and conversion or replacement or accrual to the same, held outside India by a person resident in India acquired by way of inheritance from a person resident outside India.

(iv) A person resident in India may freely utilise all their eligible assets abroad as well as income on such assets or sale proceeds thereof received after their return to India for making any payments or to make any fresh investments abroad without approval of Reserve Bank, provided the cost of such investments and/ or any subsequent payments received therefor are met exclusively out of funds forming part of eligible assets held by them and the transaction is not in contravention to extant FEMA provisions.

1.2 Section 9 -Exemption from realisation and repatriation in certain cases:

The provisions of sections 4 and 8 shall not apply to the following, namely:—

(d) foreign exchange held by a person resident in India up to such limit as the Reserve Bank may specify, if such foreign exchange was acquired by way of gift or inheritance from a person referred to in clause (c), including any income arising therefrom. (Sections 4, 8, and 9(1)(c) are reproduced below,)

[Section 4 - Holding of foreign exchange, etc.— Save as otherwise provided in this Act, no person resident in India shall acquire, hold, own, possess or transfer any foreign exchange, foreign security or any immovable property situated outside India.

Section 8 - Realisation and repatriation of foreign exchange.— Save as otherwise provided in this Act, where any amount of foreign exchange is due or has accrued to any person resident in India, such person shall take all reasonable steps to realise and repatriate to India such foreign exchange within such period and in such manner as may be specified by the Reserve Bank.

Section 9 -Exemption from realisation and repatriation in certain cases:

The provisions of sections 4 and 8 shall not apply to the following, namely:—

(c) foreign exchange acquired or received before the 8th day of July, 1947 or any income arising or accruing thereon which is held outside India by any person in pursuance of a general or special permission granted by the Reserve Bank.]

1.3 Section 9 -Exemption from realisation and repatriation in certain cases:

The provisions of sections 4 and 8 shall not apply to the following, namely:—

(e) foreign exchange acquired from employment, business, trade, vocation, services, honorarium, gifts, inheritance or any other legitimate means up to such limit as the Reserve Bank may specify.

[Sections 4 and 8 are reproduced in para 1.2 above.

RBI has issued FEMA Notification 11(R) - Foreign Exchange Management (Possession and Retention of Foreign Currency) Regulations, 2015. There is no exemption from sections 4 and 8 for holding foreign exchange acquired on inheritance.]

1.4 Section 43 - Death or insolvency in certain cases:

Any right, obligation, liability, proceeding or appeal arising in relation to the provisions of section 13 shall not abate by reason of death or insolvency of the person liable under that section and upon such death or insolvency such rights and obligations shall devolve on the legal representative of such person or the official receiver or the official assignee, as the case may be:

Provided that a legal representative of the deceased shall be liable only to the extent of the inheritance or estate of the deceased.

2. Immovable property outside India by residents:

Foreign Exchange Management (Acquisition and transfer of immovable property outside India) Regulations, 2015 - Notification No. FEMA 7(R)/ 2015-RB dated January 21, 2016:

2.1 Regulation 5(1) - Acquisition and Transfer of Immovable Property outside India:

A person resident in India may acquire immovable property outside India, -

(a) by way of gift or inheritance from a person referred to in sub-section (4) of Section 6 of the Act, or referred to in clause (b) of regulation 4. [Regu. 4(b) is reproduced below.]

[Section 6(4) is reproduced in para 1.1.1 above.

4. Exemptions:- Nothing contained in these regulations shall apply to the property –

(b) acquired by a person resident in India on or before 8th July 1947 and continued to be held by him with the permission of the Reserve Bank.]

2.2 Regulation 5(2) - Acquisition and Transfer of Immovable Property outside India:

A person resident in India may acquire immovable property outside India, by way of inheritance or gift from a person resident in India who has acquired such property in accordance with the foreign exchange provisions in force at the time of such acquisition.

3. Foreign currency accounts by Indian residents:

Foreign Exchange Management (Foreign currency accounts by a person resident in India) Regulations, 2015 - Notification No. FEMA 10(R) /2015-RB dated January 21, 2016

3.1 Regulation 4 - Opening, holding and maintaining Foreign Currency Accounts in India:

(B) - Resident Foreign Currency Account:

(1) - A person resident in India may open, hold and maintain with an authorised dealer in India a Foreign Currency Account, to be known as a Resident Foreign Currency (RFC) Account, out of foreign exchange –

(c) received or acquired as gift or inheritance from a person referred to in sub-section (4) of section 6 of the Act; or

(d) referred to in clause (c) of section 9 of the Act, or acquired as gift or inheritance there from. [Section 9(1)(c) is reproduced above in para 1.2.]

3.2 Master Direction – Deposits and Accounts - FED Master Direction No.14/2015 dated 16 January 1, 2016:

3.2.1 Part I - Opening, holding and maintaining foreign currency accounts by a person resident in India:

Para1. Introduction:

1.3 A person resident in India may maintain a foreign currency account outside India if he had maintained it when he was resident outside India or inherited it from a person resident outside India.

3.2.2 Para 3. Foreign Currency Accounts that can be held in India:

3.2 Resident Foreign Currency (RFC) Account – RFC Account

1) A person resident in India is permitted to open a RFC account with an AD bank in India out of foreign exchange received or acquired by him:

b. by converting assets which were acquired by him when he was a non-resident or inherited from or gifted by a person resident outside India and repatriated to India.

4. Overseas Direct investment in Joint Ventures and Wholly Owned Subsidiaries:

Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2004 – Notification No. FEMA 120/2004-RB - dated 7-7-2004:

4.1 Regulation 22(1) - Permission for purchase/acquisition of foreign securities in certain cases:

A person resident in India being an Individual may acquire foreign securities:—

(iii) by way of inheritance from a person whether resident in or outside India.

4.2 Master Direction – Direct Investment by Residents in Joint Venture (JV) / Wholly Owned Subsidiary (WOS) Abroad - FED Master Direction No. 15/2015-16 dated January 1, 2016:

4.2.1 SECTION C - Other investments in foreign securities:

ParaC.1. Permission for purchase/ acquisition of foreign securities in certain cases:

(1) General permission has been granted to a person resident in India who is an individual –

(c) to acquire shares by way of inheritance from a person whether resident in or outside India.

5. Realisation, repatriation and surrender of foreign exchange:

Foreign Exchange Management (Realisation, repatriation and surrender of foreign exchange) Regulations, 2015 - Notification No. FEMA 9(R)/2015-RB December 29, 2015:

5.1 Regulation 5 - Period for surrender of realised foreign exchange:

A person not being an individual resident in India shall sell the realised foreign exchange to an authorised person under clause (a) of sub-regulation (1) of regulation 4, within the period specified below:-

(1) foreign exchange due or accrued as remuneration for services rendered, whether in or outside India, or in settlement of any lawful obligation, or an income on assets held outside India, or as inheritance, settlement or gift, within seven days from the date of its receipt.

Annexure B

Extracts of FEMA law – Act, Rules and Regulations providing for inheritance in case of non-resident heir

1. Foreign Exchange Management Act (FEMA):

1.1 Section 6(5) – Capital Account Transactions:

A person resident outside India may hold, own, transfer or invest in Indian currency, security or any immovable property situated in India if such currency, security or property was acquired, held or owned by such person when he was resident in India or inherited from a person who was resident in India.

1.2 Section 43 - Death or insolvency in certain cases:

Any right, obligation, liability, proceeding or appeal arising in relation to the provisions of section 13 shall not abate by reason of death or insolvency of the person liable under that section and upon such death or insolvency such rights and obligations shall devolve on the legal representative of such person or the official receiver or the official assignee, as the case may be:

Provided that a legal representative of the deceased shall be liable only to the extent of the inheritance or estate of the deceased.

2. Immovable property in India by non-residents:

Foreign Exchange Management (Non-debt Instruments) Rules, 2019 - S.O. 3732(E) dated 17th October, 2019:

2.1 Rule 24 - Acquisition and Transfer of Property in India by a NRI or an OCI:

An NRI or an OCI may -

(c) acquire any immovable property in India by way of inheritance from a person resident outside India who had acquired such property:-

-

in accordance with the provisions of the foreign exchange law in force at the time of acquisition by him or the provisions of these rules ; or

-

from a person resident in India.

2.2 Rule 29 - Repatriation of sale proceeds:

(1) A person referred to in sub-section (5) of section 6 of the Act, or his successor shall not, except with the general or specific permission of the Reserve Bank, repatriate outside India the sale proceeds of any immovable property referred to in that sub- section.

(2) In the event of sale of immovable property other than agricultural land or farm house or plantation property in India by an NRI or an OCI, the authorised dealer may allow repatriation of the sale proceeds outside India, provided the following conditions are satisfied, namely:-

-

the immovable property was acquired by the seller in accordance with the provisions of the foreign exchange law in force at the time of acquisition or the provisions of these rules;

-

the amount for acquisition of the immovable property was paid in foreign exchange received through banking channels or out of funds held in Foreign Currency Non-Resident Account or out of funds held in Non-Resident External Account;

-

in the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties.

3. Remittance of assets:

Foreign Exchange Management (Remittance of Assets) Regulations, 2016 - Notification No. FEMA 13(R)/2016-RB dated April 01, 2016:

3.1 Regulation 4(1) - Permission for remittance of assets in certain cases:

A citizen of foreign state, not being a Person of Indian origin (PIO) or a citizen of Nepal or Bhutan, who

(ii) has inherited the assets from a person referred to in sub-section (5) of section 6 of the Act; or

(iii) is a widow/ widower resident outside India and has inherited assets of the deceased spouse who was an Indian citizen resident in India,

may remit through an authorised dealer an amount, not exceeding USD 1,000,000 (US Dollar One million only) per financial year on production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter

Provided that for the purpose of arriving at annual ceiling of remittance, the funds representing sale proceeds of shares and immovable property owned or held by the citizen of foreign state on repatriation basis in accordance with the Foreign Exchange Management (Acquisition and transfer of immovable property in India) Regulations, 2016 and Foreign Exchange Management (Transfer or issue of security by a person resident outside India) Regulations, 2000 made under the Act, shall not be included.

Provided further that where the remittance is made in more than one instalment, the remittance of all instalments shall be made through the same authorised dealer.

3.2 Regulation 4(2) - Permission for remittance of assets in certain cases:

A Non-Resident Indian (NRI) or a Person of Indian Origin (PIO) may remit through an authorised dealer an amount, not exceeding USD 1,000,000 (US Dollar One million only) per financial year,

(i) out of the balances held in the Non-Resident (Ordinary) Accounts (NRO accounts) opened in terms of Foreign Exchange Management (Deposit) Regulations, 2016/ sale proceeds of assets/ the assets acquired by him by way of inheritance/ legacy on production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter;

Provided that where the remittance under Clause (i) and (ii) is made in more than one instalment, the remittance of all instalments shall be made through the same Authorised Dealer.

Provided further that where the remittance is to be made from the balances held in the NRO account, the account holder shall furnish an undertaking to the Authorised Dealer that “the said remittance is sought to be made out of the remitter’s balances held in the account arising from his/ her legitimate receivables in India and not by borrowing from any other person or a transfer from any other NRO account and if such is found to be the case, the account holder will render himself/ herself liable for penal action under FEMA.

3.3 Regulation 7(1) - Reserve Bank's prior permission in certain cases:

A person who desires to make a remittance of assets in the following cases, may apply to the Reserve Bank, namely:

(i) Remittance exceeding USD 1,000,000 (US Dollar One million only) per financial year –

-

on account of legacy, bequest or inheritance to a citizen of foreign state, resident outside India; and

-