15th August, 2015.

Queries:

1. An Indian resident is a beneficiary in a foreign discretionary trust. What is his exposure to–

Liability to tax under ITA; and

Liability to tax under BML?

2. Does he have to disclose in his Income-tax return – his beneficial interest in the trust?

3. Explain Mumbai ITAT decision in the case of Mohan Manoj Dhupelia V. DCIT [2014] 52 Taxmann.com 146. When there are Supreme Court decisions ruling that the beneficiary of a discretionary trust is NOT liable to tax, how could ITAT decide in this manner?

My submissions:

Note: For the full forms of short forms used in this chapter, please see my chapter on BML analysis.

Before giving answers to these queries, let us discuss the applicable law.

Trust Assessment under ITA (Very Briefly) & BML.

Trust assessment law and practice were well established. Then people used discretionary trust and oral trust for tax planning on a massive scale. Hence specific anti-avoidance regulations (SAAR) were introduced in the form of S.161 (1A) & 164. These sections levied maximum marginal rate of tax on tax planning instruments. Hence trusts were dropped as a planning instrument. S.56 has made trust assessment hugely controversial. Hence the whole subject is now ignored in academic discussions. However, outside India, especially in tax havens, a discretionary trust is still a popular instrument. When a Non-Resident returns to India, he has special opportunities. He may seek advice from a tax haven consultant. If the consultant is ignorant about Indian tax law, he will still advise discretionary trust. Now under BML suddenly people have started re-examining the applicability of Indian tax law to such foreign trusts. Hence in this paper, I am summarising entire subject of trust assessment. This is a vast subject worth several papers. In this summary, only core issues are discussed and then BML is applied.

1. Let us consider trust taxation under the ITA. S.160 to 167.

In essence, the trust is a “Pass Through Entity” to use foreign terminology. “Trust is not an assessee / not a legal entity” – is the traditional Indian language. Both terms have similar consequences. In essence, the beneficiaries are liable to tax. Where beneficiaries cannot be taxed, several issues arise – some of which are discussed below.

2. Normal taxation in case of a specific trust.

Trust is not a separate legal entity under Trust Law. Even under ITA S.2 (31), a trust is not a person. Trust is not an assessee.

Trustees are the legal owners and beneficiaries are the beneficial owners. Both are assessee under ITA. “Trustees are liable to tax in the Like manner and the same extent as the beneficiaries”. In procedure, the trustees will be assessed together as one assessee. Income computed will then be allotted to the specific beneficiaries. Beneficiaries will also be assessed on their share computed on trustees’ assessment. Trustees shall not pay any tax and will get refund of TDS, if any. Beneficiaries will pay full income-tax & wealth-tax on their share of benefits. This tax is payable irrespective of whether any benefit is distributed to them or not.

In case of a specific trust, the status etc. of trustees are not relevant as in effect, the beneficiaries are being taxed.

3. In case of a Discretionary Trust, the beneficiaries don’t know what benefits they may or may not get. Hence the assessment of beneficiaries is difficult. Now the following principle is applied to the extent it is practical: “Trustees are liable to tax in the Like Manner & to The Same Extent as Beneficiaries”. How it will work out in practice is illustrated below.

3.1 Consider a discretionary trust where all trustees are non-residents, all of the trust assets are situated abroad and incomes are sourced abroad. Such a trust may be called a “Foreign Trust”. However, ALL beneficiaries are Indian residents.

The trustees are liable to pay full income-tax in India on the income earned during the previous year. To the extent of taxes paid, the beneficiaries’ right to receive benefits gets reduced.

If this trust does not pay tax in India, trustees and beneficiaries – both are liable to tax and penal consequences under ITA and now also under BML. A foreign trustee (for example, a Swiss Bank cannot raise an issue that since it is a Non-Resident of India, it is not liable to tax in India. Trustee is liable in the “Like Manner and to the Same Extent” as the beneficiary.

3.2 Another illustration where all trustees are non-residents, all income is sourced outside India; and one or more beneficiaries are non-residents. Trustees have not made any distribution during the previous year. Now trustees cannot be taxed in India. Even beneficiaries cannot be taxed because one cannot ascertain whether Indian resident beneficiary will get any benefits or not.

If in any year Indian resident beneficiaries receive any distribution of income, they will be liable to Indian Income-tax.

4. Consider a foreign discretionary trust where all trustees are non-residents, all sources of income are abroad and at least one beneficiary is a non-resident. A part of the control and management of its affairs is situated in India. May be, the Indian resident beneficiaries give instructions from India and the trustees act as per the instructions.

How will the trust be taxed?

It must be noted that in the case of a trust, the status of the trustees is wholly irrelevant. Trust income will be taxed in the like manner and to the same extent as beneficiaries.

Now when the trust is being managed from India, a whole series of new issues come up. One of them will be: The trust may be considered to be “Sham”. Then the taxability will depend upon facts. One such case is – Mumbai Tribunal’s decision in the case of Mohan Manoj Dhupelia. It is discussed in paragraph 19.3. below.

5. Now consider Specific Anti-Avoidance Provisions (SAAR). Para 6 to 11 below for ITA. Para 12 to 18 below for BML.

6. If the trust has business income, the same is taxable at maximum marginal rate – S.161 (1A).

7. Where the trust is discretionary, its income is taxable at maximum marginal rate. S. 164.

8

If the trust is an oral trust; the trust deed is not recorded in writing, then the whole income of the trust is taxable at maximum

marginal rate.

S. 164A.

9. Section 56 (1) (vii):

All the issues from 1 to 8 above were settled by the year 1984. Section 56 (1) (v) was introduced in the year 2005 as a new SAAR. With this, a new controversy has opened up. This section is further expanded periodically. If an assessee receives an amount without consideration, the amount is taxed as his income. However, if the amount is received from a relative, it shall not be taxable. 4th Proviso to S.56 (1) (vii).

In case of a specific trust, the beneficiary gets his interest immediately on settlement. Hence consider the application of S.56 at the time of settlement. If the settlor or donor who contributes the property is a relative of the beneficiary, S.56 tax is not payable. Now the beneficiary is already beneficial owner of his share. Any further income of the trust is taxable as already discussed above. S.56 has no further application.

10. S. 56 (1) (vii) applied to a Discretionary Trust.

S. 56 application may be considered in stages: (i) Settlement, (ii) Trust Earning Income, (iii) Trust Distributing Income, (iv) Trust Distributing Corpus.

10.1 Consider the application at the stage of settlement/ gift to a trust.

10.2 If the Settlor/ Donor and ALL beneficiaries are relatives, S.56 has no application. Once this stage is cleared, in all subsequent stages, S.56 cannot be applied.

10.3 Some of the beneficiaries are not relatives; and the trustee/ beneficiaries are otherwise taxable in India. Then it is not known what benefits the non-relative will get. If even one beneficiary is relative one can say that at the stage of settlement/ gift, S. 56 cannot be applied.

The AO can take exactly opposite opinion: If even one beneficiary is a non-relative, he may seek to tax the whole of the settlement / gift. In my view, this would be incorrect.

If all beneficiaries are Non-Relatives, and trustees/ beneficiaries are taxable in India, then S.56 can be applied. Tax will be payable on the total amount settled.

10.4 Since the discretionary trust is taxable in India, the income will be taxable at maximum marginal rate u/s. 164.

10.5 Consider a foreign discretionary trust. It is normally not taxable in India. Some beneficiaries are Indian residents and some are non-residents. At the stage of settlement, the beneficiaries are not taxed.

Trust earns income but does not distribute. The IR beneficiaries are not liable to tax.

Trust earns income and distributes in the same year. Even under normal provisions, the IR beneficiaries are liable to tax.

Trust distributes corpus. Can the beneficiary establish a direct link between the original settlement and the amount that he receives? In some cases, it will be possible, in some cases it won’t be possible. Where it is possible to establish the link and the beneficiary can further establish that in substance the amount is received from his relative; then S.56 has no application.

In all other cases S.56 tax is leviable.

11. Now we come to Disclosure of Foreign Assets u/s. 139. Beneficiary in a foreign trust has to disclose his interest in the trust. Simple.

12. Now apply BML to trusts:

If an IR is a beneficiary in a Specific Foreign Trust, he has to pay full taxes in India. If he has not paid taxes, BML applies. Trustees and beneficiaries – both are liable to be prosecuted under BML. Simple.

Now consider a bit complex case. Is the beneficial interest a “financial interest”?

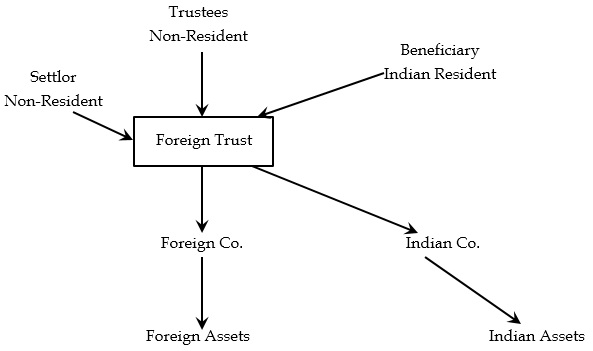

Illustration of a Foreign Trust .

Consider the illustration of an Indian Resident – Mr. IR. He sent abroad his Indian black money worth $ 10,000. His consultant in a tax haven settled a trust for him. Some NRIs act as trustees. This trust holds hundred percent shares in two separate companies. One company invests and operates outside India $ 2,500. Another company operates in India. The trust has invested $ 7,500 in India. The Indian company has grown and now shares are worth $ 30,000. Can Mr. IR say that since $ 30,000 are located in India, they do not constitute Tax Base under BML? See these facts in the chart below.

(Space kept blank due to the chart below:….. )

Observation: Beneficial Interest in trust and shares in Co. are also assets.

An asset is held by a series of intermediate entities. The interest in each foreign entity is a foreign asset. Even if final asset is held in India, the foreign asset will be exposed to BML & FEMA. Thus his total foreign assets of $ 32,500 are Tax Base under BML.

13. Discretionary Trust:

(i) If a discretionary trust is properly documented, an Indian Resident included in the list of beneficiaries is not liable to tax under BML. Simple reason for this legal position is: It is entirely at the discretion of the trustees to give or not to give any amount to any beneficiary. Unless and until the trustees allot any amount to the beneficiary, he is not the owner of a single rupee of the trust fund. He has no vested interest in the trust fund. Apply this legal position to the provisions of BML. Different provisions are considered below.

(ii) Section 2 (11) Undisclosed asset located outside India means …. an asset …. “HELD” by the assessee. In the case of a discretionary trust, the beneficiary holds nothing. All assets are held by trustees.

(iii) Section 2 (11) Undisclosed asset located outside India means an asset in respect of which the assessee is a “beneficial owner”. In a discretionary trust, the beneficiary owns nothing.

(iv) Section 4 (1) Scope of black money - …… “foreign ….. asset ….. of an assessee shall be, ….”.

Since none of the trust fund belongs to the beneficiary, it cannot be said that they are: “assets of an assessee”. Hence the trust fund in a discretionary trust is outside the scope of BML. Hence such trust assets are not liable for tax etc. under BML.

14. Consider illustration of a foreign trust deed which is faulty. For example, in a discretionary trust, there is only one beneficiary. In such a case, the trustees have no discretion except to give all the assets and income to that individual beneficiary. Trustees may postpone distribution. But can’t give the trust fund or income to anyone else. In such a case, the beneficiary has a “Financial Interest” in the trust fund. This asset can be liable to tax under BML.

15. Another illustration: In a foreign discretionary trust, there are several beneficiaries. All are Indian residents. In such a case, while no individual beneficiary will be liable to tax, the trustees of the trust will be liable to tax in India. The trustees – all of them may be foreigners and non-residents. But they are liable to Indian tax “in the like manner and to the same extent as beneficiaries”. In this case, there is no uncertainty that the whole of the trust fund and income will be liable to tax in India. If undisclosed, the trustees are liable under BML. They can file declaration under VCS. Even when the trustees are non-residents. A related difficulty is as under. If trustees file VCS form, they will get S.67 relief. Will the beneficiaries get relief? If the beneficiaries file the form, will the trustees get relief? Fair interpretation would be: one income was undisclosed. Two persons were responsible. If anyone makes a declaration, both should get S.67 relief.

16. Consider again the case of a foreign discretionary trust where one of the beneficiaries is an Indian resident. As and when the trustees make any distribution in his favour, he will be liable to tax in India. If he clearly discloses the same under his regular income-tax return; BML will not apply.

Let us say, trustees don’t make any distribution. However, when the beneficiary goes abroad, they directly pay his foreign travel cost; or the trustees pay the costs of education for beneficiary’s children studying abroad. These payments also amount to the incomes of the beneficiary and are liable to tax in India. If they are not disclosed in the regular return, they become undisclosed income.

17. Consider BML, ITA & S.56 all together:

Illustration: Trust: A settlor settles $ 1,000 in a discretionary trust in favour of his two sons. After sometime, the trustees distribute out of the corpus $ 500 to the two sons. What is the taxability of the amounts under the Income-tax Act (ITA) and under BML?

Assume that the father had settled black money. Hence $ 1,000 is an amount liable to tax under Income-tax Act as well as under BML. Once tax is levied on father’s settlement, the source becomes “explained”. Hence when the sons receive distribution of the corpus, they are not liable to further tax under BML.

Will the sons be liable to tax under Section 56 of ITA as an amount received without consideration?

No.

In a specific trust, on distribution, beneficiaries are not receiving anything without consideration. They are receiving something which already belongs to them. In case of a discretionary trust, the beneficial interest had not vested in the beneficiaries. Hence they cannot say that they had received something which already belongs to them.

However, who is the giver? Trust is not an entity. One cannot say that the trust has given. Trustees are not paying something out of their own wealth. Hence we cannot say that the trustees have paid the money. It is the settlor who has paid the money. Trustees are only managers of the funds. They have taken the decision at their discretion to distribute funds given to them by the settlor. Hence in substance and in spirit, beneficiaries have received what the settlor has paid. The relationship between the giver and the receiver is covered under Section 56. Hence the beneficiaries are not liable to tax under Section 56.

The situation would be different in following illustration: Settllor settled $ 1,000 in the discretionary trust. Then the trust earned $ 1 mn. Trustees distributed $ 500,000. In such a case, one cannot say that the beneficiaries have received what their father settled. S. 56 can apply.

18. Conclusion: In India, Trust as an instrument has become extremely convoluted and complex. It is no longer useful for tax planning or tax avoidance. Even in situations where no planning or evasion is the target, trust can cause unnecessary complexities.

19. Now we attempt answers to the queries.

19.1 The beneficiary in a bonafide discretionary trust has no liability to tax unless and until the trustees make distribution to the beneficiary. However, where the trust is found to be “Sham”; the AO may ignore the trust and tax the settlor or the beneficiaries depending upon – ‘who has actual rights to the assets & similar facts’. Under Benami Transactions Prevention Act, action can be taken against the settlor, the Trustees and the Beneficiaries. If the trust is rejected as Sham and where it is proved that Indian residents have contributed to the foreign trust, action can be taken against the person under FEMA.

The original amount settled in the trust can be taxed and trust’s income also can be taxed – both under ITA & BML – subject to the issues discussed under my paper on “Black Money Law – An Analysis”.

By making a Voluntary Compliance Declaration, the assessee can get the reliefs provided u/s. 67 of BML.

19.2 Technically, the beneficiary in a discretionary trust has no vested interest. He can’t say what amount belongs to him. Hence technically, he need not make any disclosure. However, in practice, it would be better to disclose the fact that he is a beneficiary.

The beneficiary himself may make a judgement. In case of bonafide trust where the amount of settlement and trust income can be explained to be bonafide, he need not do anything. Where in his judgement, the trust is not bonafide, he may consider disclosure under VCS.

19.3 Mumbai Tribunal Decision:

Both SC decisions and ITAT decision are simultaneously correct. The issues we need to consider are:

(i) SC decisions are based on an assumption of bonafide trusts. Mumbai ITAT has given this decision when it realised that the so called trust was a sham, a plot to evade Indian taxes. One cannot expect the judiciary to support willful evasion of tax.

(ii) Assessees and even tax consultants hope that: (a) The Assessing Officer will look at only the documents submitted by the assessee; (b) The department will not get independent information. In reality, the AO is not bound by/ restricted to the information given by the assessee. Note that tax haven Governments themselves are coming forward and giving information. GOI will get more & more information from several sources, and will use the same against assessees who have evaded tax. Those who have evaded tax by using tax havens are exposed.

(iii) In this case, the assessment was reopened in the year 2009 based on the information received by the department. At that time, probably, it was the German Government that shared information on tax havens. Note that in the ITAT decision apparently, some facts and issues have been mixed up. But that should not divert our attention from the Core Analysis.

Pranam

Rashmin C. Sanghvi.