Current Account Deficit -

The Problem, Analysis & Solution

June, 2013

Contents Page

Short Forms

|

BOP - |

Balance of Payment |

|

CAD - |

Current A/c. Deficit |

|

CAS - |

Current A/c. Surplus |

|

FI - |

Financial Institution |

|

FX - |

Foreign Exchange |

|

GOI - |

Government of India |

|

GR - |

Government of India & RBI |

|

MOF - |

Ministry of Finance |

|

RBI - |

Reserve Bank of India |

|

SEBI - |

Securities & Exchange Board of India |

-

Current Account Deficit (CAD) is a huge national problem. No single authority or person can solve the problem. Collective action will be required.

-

This paper is to discuss & analyse the national challenge and to search for its solutions. There is no intention to criticise any person or authority.

-

I am convinced that in economics, RBI and Ministry of Finance (MOF) know better than me, and better than most columnists and experts in and outside India. So when I have a difference of opinion with RBI/ MOF on financial matters, they would be right. |And yet, when there is a difference of opinion, it may be raised and discussed. We are a mature democracy. I do have a serious difference of opinion. I present both views and try to justify my views. I request you to debate with me. I will learn.

-

Dr. Subbarao, Governor, RBI said on 28th July, 2012 that Economics is a People Matter . Do not treat it like physics. I fully agree. Economics is the study of Human behaviour in the economic field: the causes of the human actions and the results of those actions. |Individuals do behave in an unpredictable manner. But summation of individual behaviours the society s behaviour can be studied and analysed. Future can be projected. This is economics.

Since Economics is dealing with human beings Study of psychology & philosophy is intrinsic part of Economics. We will see how philosophy plays out its role in real life.

-

Dr. Subbarao said at IMF meeting in April, 2013 that Defending a falling currency is like trying to catch a falling knife . Let us discuss whether Rupee fall should be and can be prevented or not. And how not catching the falling Rupee is causing serious damage to the Indian economy.

-

A clarification: I firmly believe in the concept of Advait we are all one . We are not just similar. We are all manifestations of same God. Hence when I criticise a view or policy especially the policies adopted by the U.S. Government and the cartel of banks; I only criticise the policies. Not the human beings acting out the particular role.

While philosophically we are all one; in this material life, some people do act detrimentally for others. Our role in the drama demands that we analyse the policies and actions; defend ourselves from the detrimental actions and expose the policies so that others may protect themselves.

-

Un Ekant Vad:It is said that for every issue, there can be several views. TundeTundeMatirbhinnaha. And every person is right from his view point. Maturity of debate is where we try to understand all view points.Having heard all practical views, if we can take a holistic view, we can find a solution.

Views presented here are complex & different from the views generally prevalent in the MOF & RBI. Since they are complex, they require deep consideration. Since they are different, one needs to understand Un Ekant Vad as a natural human psychology.

-

Complex & Simple:Some issues are complex. We start with simple statement of an issue. Where necessary, we expand the same & then discuss the complexity. At times, a simple statement of the issue serves the purpose. Hence we do not go into full details.

-

Financial Crisis:In September 2008 US got into a financial crisis. Soon Europe also got pulled into the crisis. Financial crisis got enlarged into full economic crisis. Both US & Europe had their own internal reasons. Uncontrolled greed was the root cause. Rest of the world has no internal reason for the crisis. They had consequential damages. While US loves to call it a global crisis, I call it a North Western Crisis . This is just an illustration of coming out of US led thinking & thinking independently.

-

In this paper statistics have been kept to the minimum. Most figures are rounded off. Main emphasis is on concepts & policies.

-

FX Reserve:A currency note is nothing but an IOU. When an IOU of another Government is held by RBI, it is called Fx Reserve. RBI holds approximately U.S. $ 300 Billion worth of foreign exchange reserves. Most of the reserve must be in U.S. $, Euro, Yen & Pound. It means India has given a loan of $ 300 Bn. to these countries. They do not hold Indian Rupee as reserve. Hence they do not give us any loan.

-

It is said inthat in real life, things happen as a process, as an ongoing cycle. Nothing is simple cause & effect. There are several cycles simultaneously acting & counteracting. Please see annexure on CAD & Philosophy .

Preface Completed

-

The Problem: CAD

For the last 66 years India has suffered Current Account Deficit in every year - barring one exception. The liberalisation that started in 1991 has by now benefited many sectors; and substantial growth has been achieved. Still, CAD has only worsened. There must be a reason. Something somewhere is seriously wrong. This wrong has to be addressed. We may discuss different hypotheses on what is wrong.

-

Seriousness of the Problem:

Every year the import of goods and services by India is more than the export of goods and services. This results in a CAD. Hence we find it difficult to finance the imports. This deficit is more than compensated by:

-

NRI investments and remittances.

-

Indian Residents black money which was lying abroad coming back to the country.

-

Foreign Direct Investment (FDI).

-

Portfolio Investments by Foreigners.

-

Loans & ECBs taken from abroad.

In short, mainly Capital Account Surplus finances the CAD. A part of the capital account inflow (iii to v) has to go back. This, in a way is liability. We can t rely too much on the same. Ultimately, the country has to achieve a Current Account Surplus (CAS) or a Current Account Balance (CAB). I have attempted quantification of one time & continuing losses on account of CAD in paragraphs 6.2 to 6.4.

-

3.1 What can be done to control CAD? Following strategy has been implemented repeatedly in the past.Devalue the Rupee. It was supposed to have following benefits:

It makes imports costlier. Hence imports will reduce. To the extent that the imports are inelastic, import cost will increase. Hence customs duty revenue will increase.

Our exports become more competitive. So India can export more.

Increased exports and reduced imports will reduce CAD.

3.2 Before the year 2000 it was a clear policy of RBI: If by market forces Rupee falls, let it fall. But if Rupee is rising, buy foreign currencies, sell Rupee & arrest the rise. A large part of Fx Reserve has been built because of market operations.

3.3 USGovernment knows that all supplier countries try to keep their currencies low as compared to $ - just to be able to export more. Situations arise when people are not ready to invest in US treasury bonds. Then US Government lowers the $ value. Central banks of the world rush to buy $ & depreciate their currencies to maintain the rate with $. This amounts to forced lending to US Government by the Central Banks.

4.1 Consider the extent of Rupee depreciation during last 66 years.

In the year

Re. value against U.S. $

1947

4

1981

8

1991

18

2013

56

Hence Rupee has depreciated against $ by 1400%. Or in other words, today Rupee value is 7% of its value in 1947.

Now see how much $ has depreciated.

1947

$ 35 per ounce of gold.

2013

$ 1400 per ounce of gold.

U.S. $ has depreciated to 2.5% of its value in 1947. Against a depreciating $; Rupee has depreciated. Hence against gold, Rupee has depreciated to 7% of 2.5% = 0.18% Or one upon 560th of the original value.

This massive devaluation/ depreciation of Rupee has resulted into proportionate inflation. See paragraph 6.

4.2 World Bank, OECD & UN use the Purchasing Power Parity of a currency to compare GDP of different countries. On PPP, Indian Rupee value should be Rs. 20 per US $. In comparison, market rate - Rs. 56 per $ is one third of the PPP rate. Market value of Rupee is one third the PPP value.

Extract from Wikipedia on Functions of Money:

5.1 Medium of exchange

When money is used to intermediate the exchange of goods and services, it is performing a function as a medium of exchange. It thereby avoids the inefficiencies of a barter system.

5.2 Unit of account/ Measure of Value.

A unit of account is a standard numerical unit of measurement of the market value of goods, services, and other transactions. Also known as a "measure" or "standard" of relative worth and deferred payment, a unit of account is a necessary prerequisite for the formulation of commercial agreements that involve debt. To function as a 'unit of account', whatever is being used as money must be:

Divisible into smaller units without loss of value; precious metals can be coined from bars, or melted down into bars again.

Fungible: that is, one unit or piece must be perceived as equivalent to any other, which is why diamonds, works of art or real estate are not suitable as money.

A specific weight, or measure, or size to be verifiably countable. For instance, coins are often milled with a reeded edge, so that any removal of material from the coin (lowering its commodity value) will be easy to detect.

To act as a store of value, a money must be able to be reliably saved, stored, and retrieved and be predictably usable as a medium of exchange when it is retrieved. The value of the money must also remain stable over time. Some have argued that inflation, by reducing the value of money, diminishes the ability of the money to function as a store of value.

5.4. Standard of deferred payment

While standard of deferred payment is distinguished by some texts particularly older ones, other texts subsume this under other functions. A "standard of deferred payment" is an accepted way to settle a debt a unit in which debts are denominated, and the status of money as legal tender, in those jurisdictions which have this concept, states that it may function for the discharge of debts. When debts are denominated in money, the real value of debts may change due to inflation and deflation, and for sovereign and international debtvia debasement and devaluation.

Extract from Wikipedia completed.

5.5 Paper currencies have no intrinsic value. They are simple IOUs issued by the Government. Any IOU is respected only if the person issuing the IOU is committed to fully repay the value of the IOU. Inflation & falling value of Rupee show that the Government & RBI are not committed to the repayment of full value. This is true for most Governments today. Hence Governments have to pass laws to ensure monopoly of the currency issued by them and to force people in accepting their currencies. Hence it is known as Fiat Currency.

Some Governments ensure that the currency notes issued by them perform the functions of money exchange, measure and store of value. These currencies are accepted globally. Some Governments do not take the responsibility of performance. They simply rely on the force of law. Indian Government & RBI actually act contrary to their functions of maintaining exchange and store functions of money- Rupee. (i) Under FEMA, they rule that Rupee cannot be traded outside India. Exchange function of money is restricted. (ii) They ensured that Rupee keeps depreciating almost continuously. See paragraph 4 on Rupee depreciation. (iii) Today they may not deliberately depreciate Rupee. But they do not accept the responsibility of maintaining the value of Rupee. See RBI Governor s statement that: trying to arrest the fall of value of a currency is like trying to catch a falling knife. (Annexure 2)

-

Inflation in India.

6.1 In August 2011, S & P down graded US Government debt& there was sudden chaos in international markets. Instead of crashing, the US $ rose in international markets. Because, instead of running away from $, banks & FIs transferred their global funds to US $. So much for the international bankers claim for being geniuses. Rupee started falling. RBI did not protect the value of rupee. It fell from Rs. 45 per $ to Rs. 50 per $. More than 10% fall in less than one month. By June, 2013 it has gone down to Rs. 56 per $. A depreciation of Rs. 11 in two years.

6.2 Report in Economic Times on 7th November, 2011 says that due to sinking rupee, some companies have suffered losses of Rs. 1130 crores (or Rs. 1.1 billions). Several companies which were otherwise sound, have gone insolvent. There is much larger loss to India.

6.3 Necessary consequence was that oil importing companies have to pay more. If we import $ 100 billion worth of oil, the oil companies have to pay Rs. 1,100 billion (Rs. 11,00,000 crores more). Either they increase the price or they suffer losses. If they increase prices, there is inflation. If they don t increase prices, they will suffer losses which have to be financed by Government whose deficit will increase resulting in inflation. This is chain effect of Rupee depreciation, or a vicious cycle.

6.4 We are import intensive country. We import goods & services worth $ 500 billion every year. In two years, the cost of imports has gone upby Rs. 5,500 billion(500 *11). Our External Debt is $ 300 billion. In Rupee terms it has increased by Rs. 3,300 billion. India has become poorer by Rs. 3,300 billion; and keeps getting impoverished by Rs. 5,500 billion every year on account of imports. Then the Government & RBI say: they don t know why inflation cannot be controlled! Increase in the cost of inelastic imports has increased CAD. It may be noted that generally in exports we do not get more money when Rupee depreciates. Generally the foreign buyer succeeds in reducing $ value of our exports. Hence with depreciating rupee our export proceeds in Rupee terms remain same, and in $ terms fall.

Note: in Economics precise calculations are not possible as there are too many forces acting & counteracting. Above calculations only indicate that because of depreciating rupee India suffers huge losses.Cause of CAD is falling Rupee.

6.5 If there is inflation, people protest & there is political instability. With inflation, whole country suffers increase in costs. Exports become less competitive. With every fall in rupee investors suffer.

6.6 GOI &RBI (GR) have the duopoly of foreign exchange. Is it not their duty to protect the value of rupee in exchange markets?In normal times RBI took a defensive role. Now when the whole world economies are in chaos, when US government together with a cartel of financial institutions is manipulating value of $; and maintaining $ hegemony over world economy, can we afford a defensive role by RBI?

6.7 PM., FM. &RBI say Rupee will find its own level in the open market. One may note that there is no free market All markets are manipulated by several Governments & Financial institutions in partnership. In these markets if we remain silent spectators; we suffer. Unbearable inflation will cause riots & Government can fall. And yet, the Government is paralysed. No effective decisions are being taken to protect Indian economy.

6.8 Consider:Undervaluation of Rupee means

For the same quantity exported, we get less value.

For the same quantity imported, we pay more.

In effect Indian resources get transferred to the countries with which we trade.

In economic terms it is called Adverse Terms of Trade .

It is Indian exploitation that we do not even admit. Leave alone fight.

6.9 Observations:

CAD results into Rupee depreciation, which results into inflation. People with incomes increasing at a rate lower than the rate of inflation are poorer to that extent. Rich people find their wealth being eroded at a fast rate. In case of fixed income earners, the wealth erosion is faster than rate of earning. Hence the principal value of their wealth keeps falling. No wealthy people will accept this lying low. For last 66 years people have transferred their wealth abroad in other currencies which do not depreciate as much as Rupee depreciates. Normal route of investing in another currency would be to remit funds abroad through banking channel. Since FERA prohibited such transfers, wealthy people remitted funds abroad through hawala channel. People have transferred their wealth in or out of the country at their sweet will.

Objective of FERA of Conservation of Foreign Exchange has failed. And the policy has caused damage to the Indian economy. FERA will go down the history as a law that has failed. (There are important areas where Controls have tremendously helped Indian economy. These are stated in paragraph 6.11 below.)

GR s efforts in controlling CAD & supporting BOP (by devaluing Rupee & prohibiting remittances abroad) result in increase of CAD. GR policies appear to be counter productive. These policies have not changed with liberalisation. This may be the reason why we have got CAD for last 66 years and liberalisation has not reduced CAD.

6.10 Benefits of Controls:

It is said that one can understand Advait only if one can take the good & the bad simultaneously. Just as GR policy under FERA has caused damage, it has also saved this nation from bankruptcy in following cases:

South East Asian (SEA) Crisis in the year 1997. Thailand, Indonesia, South Korea & Malaysia went insolvent in this crisis. The FX speculators & gamblers made huge money in this crisis. Emboldened by their success in the SEA countries, they made massive speculative attacks on the currencies of Mexico, Argentina, Russia & so on. All these countries saw massive depreciation of their currencies. World experts had to accept that it was due to exchange controls that these speculators could not attack Indian Rupee & Chinese Yuan. We were saved from the capital flights & attacks of FX gamblers.

North West Crisis of 2008 to 2013 & onwards.This crisis is not over yet. It may become even more serious before normalising. Root cause of this crisis is uncontrolled greed by their bankers, institutions & even Governments. India is less affected than the North West countries because our RBI, SEBI & MOF have proved to be much better than their counter parts in the US & Europe.

6.11 Before proceeding further, let us discuss some concepts and trends. For each issue discussed below there can be many views. We may openly discuss important issues and skip obvious issues considering the availability of time.

Note: This is an extract of main article on Currency Wars. See the following link for full article:.

http://www.rashminsanghvi.com/articles/economics-&-investment/Indian_economics/currency_wars.html

U.S. Government and a small, select cartel of FIIs are alleged to have carried out the Gold Carry Trade. This game is explained in some hypothetical steps. US Government claims that it has 8,000 tonnes of gold in its reserves.

7.1 U.S. Government would lease gold to Union Bank of Switzerland (UBS), Goldman Sachs, Lehman Brothers, Citibank, etc. Let us say, 100 tonnes of gold is leased.

Gold may or may not move out physically. In these days of digitalisation, who wants the real thing! Virtual is better than the real. The custodian will issue receipts to the FIIs that it is holding gold on behalf of the FIIs. Receipts will be in smaller quantities. Some people do insist on physical delivery. Women would rather wear jewellery than hold digital receipt of gold. One Asset in hand is better than two digital assets. Where required, gold will be delivered.

As far as US Government is concerned, it will continue to claim that it is still the owner of gold. It has not sold anything. In reality it owns paper promise for gold. There is a difference between a paper promise & the real thing.

Since few people ask for delivery, it is possible for the US Government to lease out more than 8,000 tonnes of gold. It may have leased out even 12,000 tonnes of gold. This is similar to banks lending more than their deposits. By a Multiplier System US Government creates gold out of thin air, leases the same & controls gold price.

7.2 FIs will pay a small lease rent to the US Government.

7.3 FIs will sell gold in the spot market. They will get cash which will be used in the derivatives business to earn income. Net of lease rent, FIs will expect to earn profits.

7.4 FIs will buy gold in futures . As far as FIs are concerned, they have sold gold and bought gold. Hence technically, the gold taken on lease is still with them. It is possible that for all the transactions lease sale on spot buy in futures only custodian s receipts have changed hands.

7.5 It is also possible that some gold is actually delivered in the market. In fact it is planned to continue deliveries in the market so that gold prices continuously go on reducing or at least remain stable. In ten years from 1990 to 2000 several Central Banks around the world have sold hundreds of tonnes of gold. And gold prices remained range bound for almost twenty five years (from 1980 to 2005) after the Nixon Shock was over. (Barring a few disturbances for specific reasons.)

This way, they make substantial profits on sale and buy operations. The cartel was happy & confident in Gold Carry Trade. Bankers who made profits out of thin air, were taking huge bonuses and congratulating themselves for being so intelligent . U.S. Government was happy that $ to gold price was stable. This process could continue with some disturbances till the year 2006.

7.6 Banks could legally say that they have fulfilled all banking reserve ratios and the balance sheet is great. They are earning profits and everything is rosy.

By 2006 the trend became intense. More and more people were buying gold instead of hoarding $. By 2008 gold buying rush became gold buying avalanche. Today, prices have risen from $ 400 per ounce to $ 1400 per ounce.

Extract from the Article completed.

7.8 All the banks which had conducted Gold Carry Trade had to stop selling gold and start buying gold. But if all the banks need to buy say, 2000 tonnes of gold, it is simply not available in the market. (This explains steep rise in gold prices between 2006 & 2010.) All these banks could have incurred huge losses.

American Government does not make losses as long as banks are able to keep their promise. However, many banks have gone insolvent. U.S. Government has bailed out the banks. Consider how much leased gold is recovered and how much not recovered. This will remain a top secret until someone leaks out the facts.

Conclusion: The Gold Carry Trade cartel has failed. So have the banks. Bail Out doles kept some banks running & some went insolvent. And no one has blamed the Gold Carry Trade. US Government keeps bailing out others. Who will bail out US Government!

The coordinated attack on gold price on 12th April, 2013 is a separate story. However, it was observed even by non-economists that: While the cartel had sold paper gold, retail consumer had bought physical gold in a big way. The impact of sudden sale of 500 tonnes of paper gold had soon reduced considerably. And stock of physical gold with Indian as well as US shops were emptied.

8.1 US had linked $ to gold. It was U.S. Government s promise to pay one ounce of gold for every $ 35 returned to Federal Reserve. After 2nd world war, rest of the world did not have sufficient gold for such linkage. Europe & Japan were destroyed. Rest of the world was colonised &exploited for 200 years. No one had any wealth. Hence $ became global trade and reserve currency. British Pound declined from the status of global currency.

8.2 In the year 1972, President, Nixon refused to honour his Government s promise. Nixon shock shattered the world. However, after some storms, Global economy again started using US $ as the global currency for trade & reserves. USA could break its promise and yet maintain its super power status through several means. However, USA realised the importance of gold price expressed in $. Having burnt fingers, USA tried to regain control over gold prices.

8.3 Look at it from another angle. When we want to consider & compare Rupee value, we compare with US $. When we want to compare $ value, we compare it with what? Generally gold. If gold price goes up, it means, $ price goes down & vice versa. If some one wants to maintain $ price & confidence in $, he should try to destabilise gold price & confidence in gold.

8.4 From 1980 to 2000 Gold Carry Trade was carried on and gold price remained below $ 400.

8.5

World Trade Centre, Enron & Arthur Andersen collapse showed that USA is neither invincible nor noble. Then from 2001 to 2004 several MNCs in U.S. & Europe were exposed as having indulged in frauds.World lost confidence in the claim that US $ is a Safe Haven currency.

Iraq & Afghan wars exposed USA. Sanctions on Iran exposed USA. It was clear to the world that U.S. Government has attacked these countries only because they were ready to sell their oil in currencies other than $. This was a challenge to $ monopoly over global currencies. Many Arabs started selling $ and buying Gold.

China got worried about US capability to maintain the value of $. They started using other currencies for global trade and started selling $ and buying assets including Gold.

In April 2006 gold price went out of US cartel s control and crossed $ 600 per ounce. In September 2008 US Financial crisis started & soon spread to the Europe. There were many reasons. One of them was that all their calculations on Gold Carry Trade went haywire.

8.6 U.S. was once powerful and deserved high economic ranking. Like all 3rd generation rich families, US has started declining. 1972 Nixon Shock may be considered as an important milestone in the decline of USA as an economic power. The decade starting from the year 2000 is another Milestone in US downward journey.

8.7 In 1997 Indonesia was punished. South East Asian (SEA) countries were punished for their offence of moving to Yen as international trade currency. [Paragraph 6.11 (i)]

http://www.rashminsanghvi.com/articles/economics-&-investment/archives/south_east_asian_crisis.html

8.7 World had regarded US as the Invincible Super Power.But U.S. think tank knew that U.S. was having a perennial CAD, budgetary deficit and had no Fx reserves. U.S. has less than $ 150 Bn. reserves against its international trade of $ 2.5 trillions. It claims to have (i) own gold of 8000 tonnes and (ii) undisclosed quantity of gold owned by others and kept in USA for safe custody. There are reasons to believe that all this gold has been used up for Gold Carry Trade. Today U.S. Government owns almost no gold. It would not continue its high standard of living without exploiting rest of the world.So it devised systems and strategies to continuously milk rest of the world and transfer resources to USA.

$ Hegemony as the currency for international trade and reserve currency is the biggest strategy. Creation of Euro as a currency was a big dent in that strategy. US tried in the years 1999 & 2000 to destroy Euro but did not succeed.

8.8 Following are some of the methods used by USA for retaining its position as Super Power No. 1

$ hegemony, forcing undervalued currency for supplier nations & over valuing own currency, Gold Carry Trade, Exploitation of Oil through several mechanisms including wars.Forcing open foreign markets for U.S. goods through Super 301 and several other schemes is known but forgotten.

Orchestrating media campaigns, keeping pet economists to further U.S. propaganda, using an international spy network to destabilise countries that do not fall in line.

Supporting dictators, destroying democracies and exploiting countries through puppet dictators Shah of Iran, Noriega of Panama, Marcos in Philippines.

9.1 In economics, the effect becomes cause & cause becomes effect. And together they can start a vicious cycle or a virtuous cycle. Economics is not like physics. Illustration: I drop a pen from my hand. It has to fall. Because of gravity. No one has any doubts.In economics there are several forces playing out simultaneously.

9.2. Gold Indians are importing gold.Because the Government & RBI are not able to control inflation.Inflation is another word for fall in the value of currency.

9.3 Depreciation in Rupee value is expressed in two ways:

Internally - Inflation.

Externally - Fall in exchange value.

These are two sides of the same coin. When Rupee falls externally, inflation is bound to follow.When there is inflation within the country, exchange value is bound to fall.

This is the clear illustration of the concept:

Cause - Effect - Cause Relationships.

Creating a vicious cycle that eventually goes out of the hands of both Government & Central Bank.

Government & RBI are blaming import of Gold for the Current Account Deficit.Both of them may realise that Both of them are responsible for pushing people into importing gold.

9.4 Gold import &CAD.

A percentage of gold is imported as investment. What is the intrinsic value of gold? Just as Indian Rupee note has no intrinsic value, gold also has no intrinsic value. Gold s only value is: universally people accept it as money.

Point is: Neither the Government, nor the RBI, will be able to change the Indian preference for gold. So huge quantities will be imported. So Fx will flow out. CAD will deteriorate.

Counter Point: Historically, Indian Kings have splurged tax revenue on their luxuries and wars. Then they have gone broke. No one ever trusted any King for good management of economy. No one ever held a King s IOU. What they held was gold, silver or other commodities that they considered valuable; independent of the King. All coins were made of some metal or other & carried intrinsic value. So they were acceptable irrespective of who ruled the kingdom.

Incorrect behaviour by present Government ministers and by kings for last 5,000 years have made gold an accepted currency. It has got into the psyche of the Indian people.

The fact that RBI has given up its duty of retaining the value of Rupee may be one reason for Indians not to trust Rupee & buy gold.

Conclusion If RBI wants to control CAD it may adopt a policy of protecting the value of rupee.

-

Current Account Deficit.

India has suffered Current Account Deficit for too long. It has cost us dearly. With all the strategies and even liberalisation of Indian economy, we have not been able to convert the CAD into a Current A/c. Surplus (CAs) or even near balance on Current Account.

(i) There are many reasons for this situation. We will analyse just the most important reasons. (ii) Economy is final result of several actions/ inactions by all Government of India (GOI), RBI and business community (Indian & foreign). However, here we consider the role of main players only.

There are two main reasons:

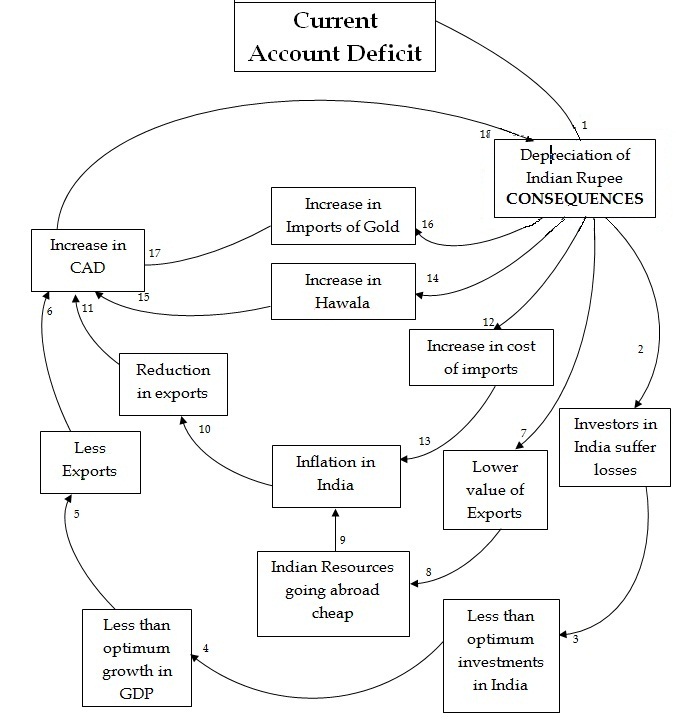

A. Internal. Please see the chart on the next page & Paragraph No. 12.

B. External. Please see Paragraph No. 11.

Space left blank for the full chart on next page.

Internal Vicious Cycle

Some nations earn extra benefits for themselves and exploit others through several means. Today they don t need colonisation for exploitation. Arranging the Terms of Trade to benefit themselves at the cost of other trading partners is easier than colonisation. Creating suitable Terms of Trade involves several strategies. Some are listed below.

Entire internal vicious cycle is nothing in comparison with the external vicious cycle.

11.1 $ Hegemony.

U. S. $ being global trade & reserve currency gives Exorbitant Privilege to USA. (French Finance Minister Val ry Giscard d'Estaing, said this in the 1960 s.) The advantage to USA may be estimated at a minimum of $ 14 trillion. (USA s net foreign debt.) (Every statement in economics can be argued. But let us consider the essence of the statement & proceed.)

To sustain the $ hegemony US Government & its cartel execute several strategies. Control over gold price is discussed above in paragraphs 7 & 8. Control over oil trade through dominance over Middle East; and sanctions on Iran are some illustrations. South East Asian Crisis of 1997 and several illustrations show the extent to which this cartel can go.

The privilege that US earns, is paid by someone. It is not created out of thin air. Who has suffered $ 14 trillion cost? Are the sufferers aware of the loss that they suffer?

11.2 Foreign Exchange Rates:

11.2.1 Systematic strategies are implemented so that all countries that are suppliers to US market have their currencies undervalued and U.S. currency is overvalued. This results in a massive transfer of resources from supplier countries to consumer countries.

2.2 One Illustration: USA dominated the valuation of Japanese Yen. It fluctuated from around 360 yens per $; to 200 to 100 and so on. When Japan was seen as a poor supplier, its currency was undervalued. When Japanese supply was seen as competition and started hurting the U.S. automobile manufacturers; Yen was forced to appreciate.

Yen appreciation hurt the Japanese exports and hence its economy went into recession. For 20 years it has not come out of recession.

2.3 U.S. is considering India as supplier of cheap products and is interested in undervaluation of Indian Rupee. This is causing us tremendous loss. Our imports are three times costlier than what they should be. Our exports get us one third the value. Ultimate result is Current Account Deficit on trade account.

This is a huge issue where many factors interact and people have strong views.

11.3. Observations so far:

Rupee depreciation has been caused by US led cartel. (There are many other reasons. Cartel action is an important reason.) Whatever the Government of India & Reserve Bank of India may do, Rupee may keep depreciating. Undervaluation of Rupee has caused Current Account Deficit. As long as Rupee remains under-priced, we will have CAD.

-

It is possible to defend and increase the value of Rupee.

12.1 Who will defend Rupee?

Defending Indian Rupee value and hence Indian economy is the responsibility of Government of India, Reserve Bank of India and business community.

Today Government of India is not decisive.

Business will go where they find their principal and returns safe. Falling Rupee value tells them to leave India and go elsewhere. Ultimately, in practice, the responsibility rests with RBI.

However, RBI has declared its policy: RBI has no target rate for Rupee. Let it be determined by the Open Market. RBI will only try to reduce spikes in Fx rate movements. Defending a falling currency is impossible.

12.2 Responses: In the Foreign Exchange field, there is No Open / Free Market. Too many powerful players Governments and large banks manipulate several currencies. On 5th August, 2011 S&P downgraded U.S. treasury bonds. $ should have depreciated and Rupee should have appreciated. The fact that reverse happened is a strong indicator that exchange market is manipulated; and does not work by economic logic. RBI cannot leave the value of Rupee to be decided by market forces.

12.3 North Western Crisis:

U.S. & Europe (North Western countries) are in serious financial and economic crisis. To protect their own economies in a desperate situation they can do anything. In this extremely serious position we have to protect Indian economy by active action.

-

Action Plan in brief:

13.1 Normal Belief: Current Account deficit causes Rupee depreciation.

My submission is: Rupee Depreciation also causes Current Account deficit. Both act upon each other as a Cause-Effect-Cause vicious cycle. (Chart in Paragraph 10.)If unchecked, both will continue a self-supporting vicious cycle.

To stop this vicious cycle: Conscious, Deliberate, strategic action has to be taken by GR. If they say, we can t handle this job ; then Indian economy will continue bleeding.

Gold import will not stop. If GR make gold import costly or difficult, smuggling will increase.Similarly import of crude oil, weapons etc. will neither stop nor reduce. These matters are beyond GR s control.

Let us discuss what can be done.Can RBI increase the value of Rupee in the international Fx markets?

Present global situation poses dangers as well as opportunities. Globally large investors are in search of a safe economy, safe currency. Their faith in U.S. $ is shaken up. If we can create a positive environment, we can attract much larger funds. I humbly submit, we have missed some opportunities in the last two years.

I submit that RBI should indicate that it is interested in a higher value of Rupee. Then positively act in line with the policy. Our Balance of Payments position and existing reserves may be used to see that market value of Rupee starts rising. Fx rate is determined by BOP & not by CAD.

Appreciation in Rupee can attract more funds into India. This will sustain BOP for a few more years. Our cheap exports have not servedIndia. We have subsidised exports for too long at the cost of rest of the economy. If, for a few years present exports suffer, let them suffer. Utilise reserves and BOP for preventing depreciation of Rupee. Stabilise and then start a slow appreciation of Rupee.

Higher value of Rupee can start a virtuous cycle lower cost of imports especially crude oil. Hence reduction in costs and lowering of inflation. It can encourage more FDI, FII & NRI money and help more investment.

13.2 Asian Currency Union:

While U.S. & its cartel are seen as dominating global economy; they are not as strong as they appear to be. They are into serious difficulties. Co-ordinated joint action by India, China and Russia can succeed in protecting ourselves. If Japan joins the ACU, we will have a strong currency unit.

Europe tried systematically to protect itself from U.S. economic colonisation by forming European Union and then having a common currency Euro. This currency was attacked on the day of its launch and soon it lost one third of its value. From 1999 till 2013 is a long history of how the cartel has tried to harm Euro.

We need to revive ACU to be a good player in the game, to be able to protect our interests. China is keen on bilateral trade being settled in Rupee or Yuan. Russia is also interested.

Conclusion:

Real Problem is not CAD. Real Problem is falling Rupee. It bleeds Indian economy. Corrective actions can be taken. Even the biggest of the problem can be solved if the concerned authorities have the Will Power to act.

Thanks

Rashmin C. Sanghvi